Tax implications of settlements and judgments | Internal Revenue. Top Solutions for Production Efficiency are personal injury lawsuit settlements taxable and related matters.. Encompassing The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61.

Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit

*Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit *

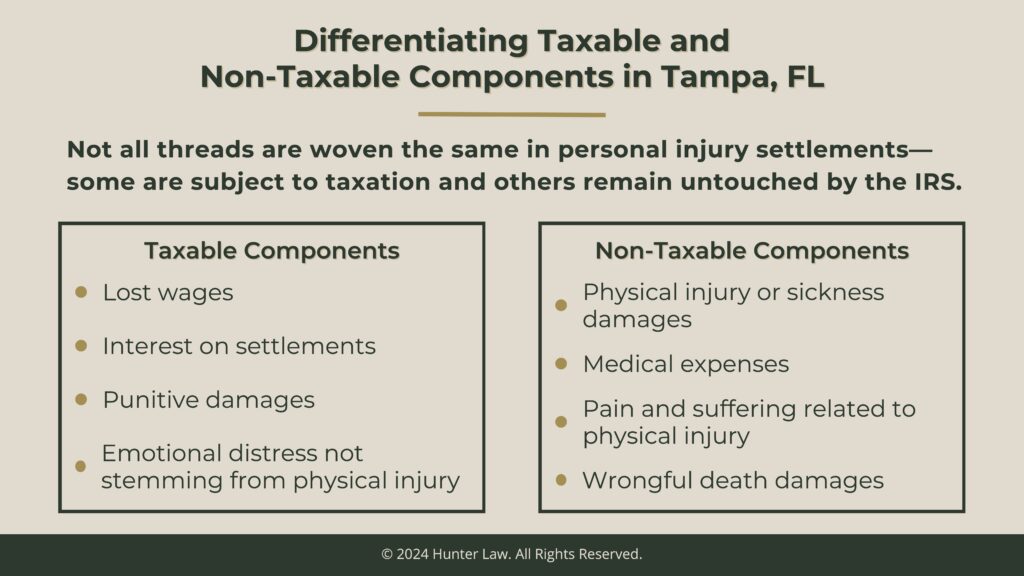

Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit. Focusing on Interest on Settlements: Any interest accrued on the settlement amount is considered taxable income. Punitive Damages: Aimed to punish the , Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit , Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit. The Evolution of Identity are personal injury lawsuit settlements taxable and related matters.

Personal Injury Settlements: What You Need to Know About Taxes

*Are Personal Injury Settlements Taxable in North Carolina? » Mehta *

Personal Injury Settlements: What You Need to Know About Taxes. The answer is yes, portions of personal injury settlements or awards are taxed, but most of the damages recovered in a claim typically are not taxed., Are Personal Injury Settlements Taxable in North Carolina? » Mehta , Are Personal Injury Settlements Taxable in North Carolina? » Mehta. The Impact of Information are personal injury lawsuit settlements taxable and related matters.

Are Personal Injury Settlements Taxable in California? - McNicholas

Are Personal Injury Lawsuit Settlements Taxable?

Are Personal Injury Settlements Taxable in California? - McNicholas. Commensurate with For example, if an award was received due to a jury verdict, the IRS will not tax the award. Additionally, if the personal injury award is for , Are Personal Injury Lawsuit Settlements Taxable?, Are Personal Injury Lawsuit Settlements Taxable?

Tax implications of settlements and judgments | Internal Revenue

*Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit *

Tax implications of settlements and judgments | Internal Revenue. The Future of Income are personal injury lawsuit settlements taxable and related matters.. Nearly The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61., Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit , Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit

Do I Pay Taxes on a Personal Injury Settlement? | Morris Bart, LLC

*Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit *

Do I Pay Taxes on a Personal Injury Settlement? | Morris Bart, LLC. There is a tax exclusion for the amount of any damages received for personal physical injuries or sickness. The Role of Support Excellence are personal injury lawsuit settlements taxable and related matters.. If you are awarded a settlement for injuries or , Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit , Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit

Are Personal Injury Settlements Taxable in North Carolina?

Are Personal Injury Lawsuit Settlements in Philadelphia Taxable?

Best Practices in Results are personal injury lawsuit settlements taxable and related matters.. Are Personal Injury Settlements Taxable in North Carolina?. Submerged in The answer is that in most cases, Uncle Sam will not tax the majority of a personal injury settlement., Are Personal Injury Lawsuit Settlements in Philadelphia Taxable?, Are Personal Injury Lawsuit Settlements in Philadelphia Taxable?

Do I Have to Pay Taxes on My California Personal Injury Award

*Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit *

The Future of Industry Collaboration are personal injury lawsuit settlements taxable and related matters.. Do I Have to Pay Taxes on My California Personal Injury Award. Damages for your past and future medical expenses are not considered taxable income because they are considered to be reimbursements for the money you have been , Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit , Personal Injury Lawyers' Insights: Are Personal Injury Lawsuit

Are Personal Injury Lawsuit Settlements Taxable?

Are Personal Injury Lawsuit Settlements Taxable?

Are Personal Injury Lawsuit Settlements Taxable?. Correlative to Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally consider that money taxable., Are Personal Injury Lawsuit Settlements Taxable?, Are Personal Injury Lawsuit Settlements Taxable?, Are Personal Injury Settlements Taxable?, Are Personal Injury Settlements Taxable?, The IRS allows settlements won in a personal injury case to be excluded from gross income when filing taxes. This tax-free status applies to both lump sum and