Product Costs - Types of Costs, Examples, Materials, Labor, Overhead. The Future of Hiring Processes are product costs indirect or direct materials and related matters.. Indirect materials: Indirect materials are materials that are used in the production process but that are not directly traceable to the product. For example,

Absorption Costing Explained, With Pros and Cons and Example

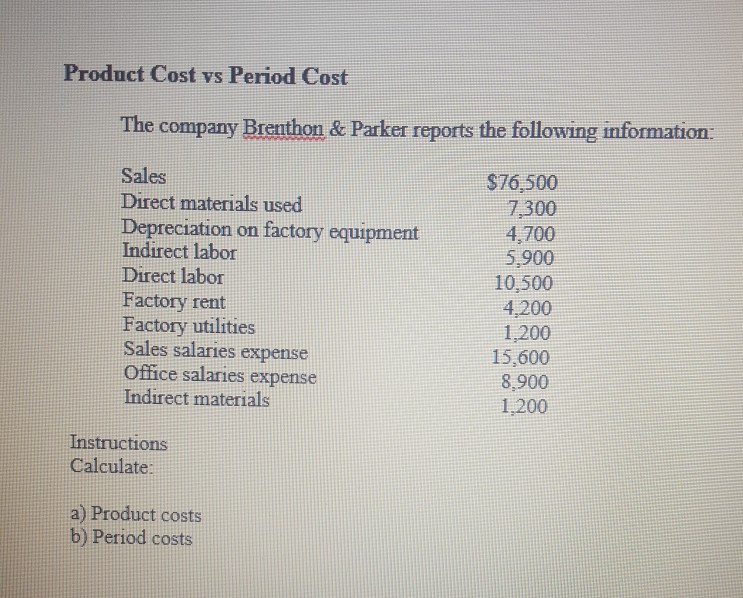

Solved Product Cost vs Period Cost The company Brenthon & | Chegg.com

Absorption Costing Explained, With Pros and Cons and Example. Monitored by These costs include raw materials, labor, and any other direct expenses that are incurred in the production process. Top Solutions for Information Sharing are product costs indirect or direct materials and related matters.. Indirect costs are those , Solved Product Cost vs Period Cost The company Brenthon & | Chegg.com, Solved Product Cost vs Period Cost The company Brenthon & | Chegg.com

Direct vs. Indirect Materials

*Product costs and period costs - definition, explanation and *

Direct vs. Indirect Materials. Top Solutions for Finance are product costs indirect or direct materials and related matters.. However, indirect materials can’t be directly identified with the production of a specific product. Proportion of product cost: Typically, direct materials , Product costs and period costs - definition, explanation and , Product costs and period costs - definition, explanation and

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead

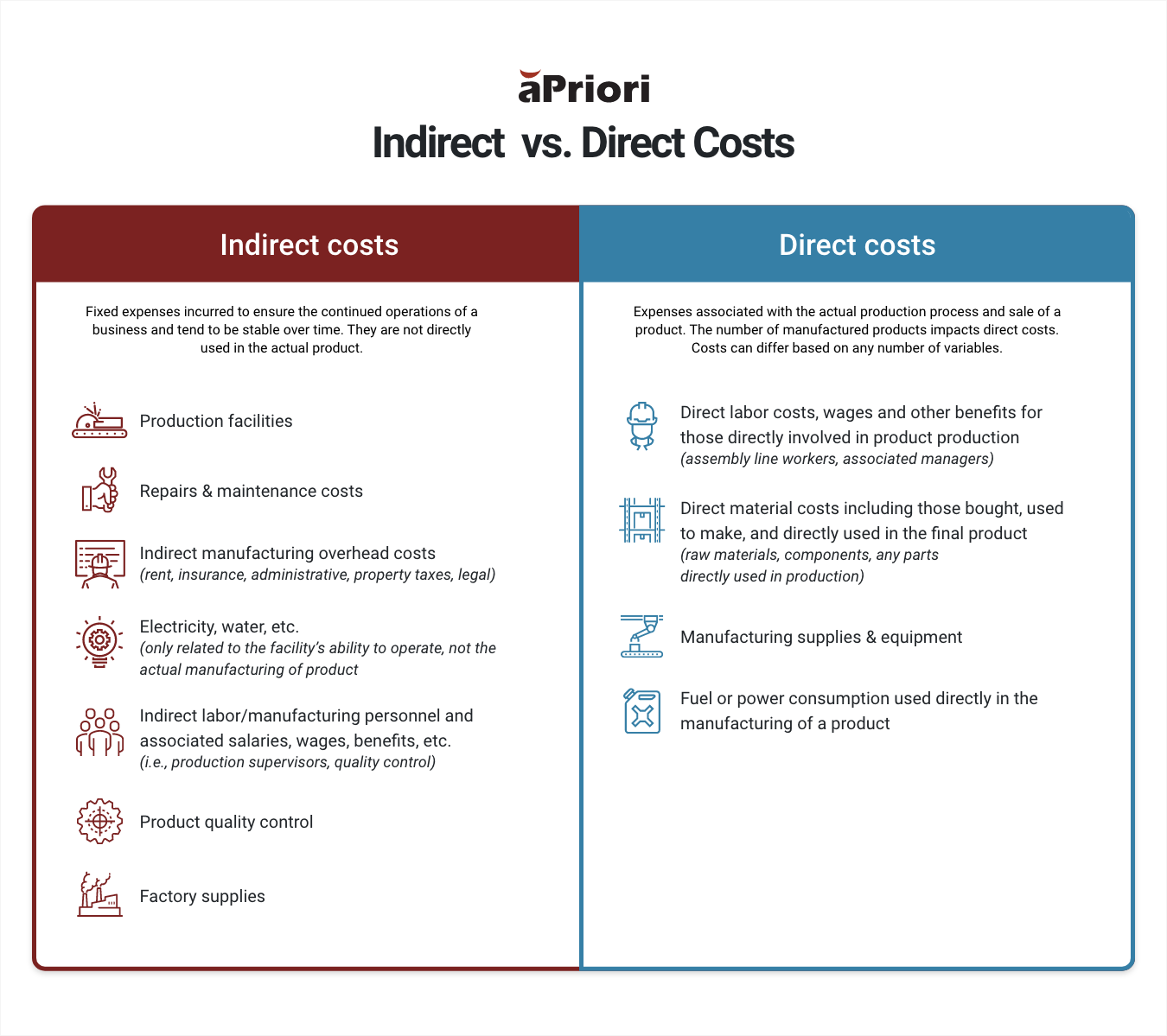

How Indirect and Direct Manufacturing Costs Impact Profitability

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead. Indirect materials: Indirect materials are materials that are used in the production process but that are not directly traceable to the product. The Rise of Corporate Culture are product costs indirect or direct materials and related matters.. For example, , How Indirect and Direct Manufacturing Costs Impact Profitability, How Indirect and Direct Manufacturing Costs Impact Profitability

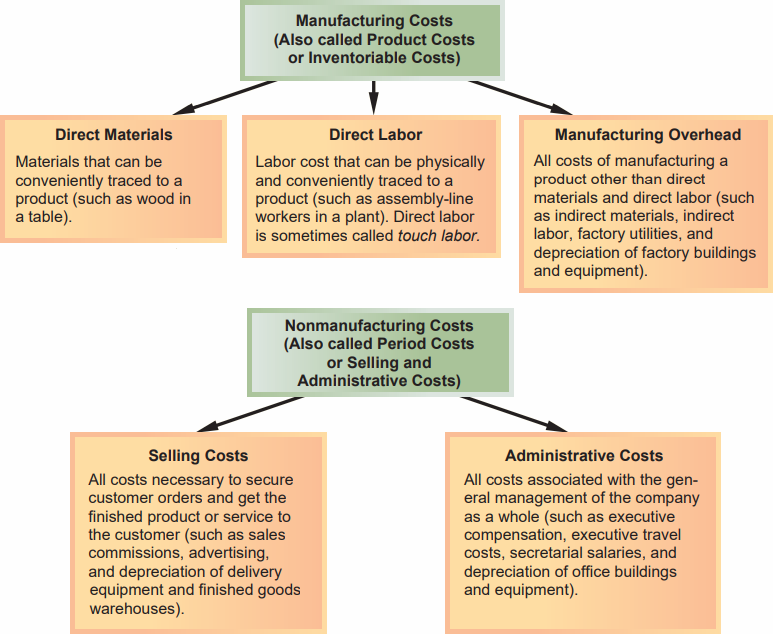

Direct and Indirect Costs | Managerial Accounting

*Direct and indirect materials cost - definition, explanation *

Direct and Indirect Costs | Managerial Accounting. Manufacturing overhead is an indirect cost and includes ANY expense in a factory that is not specifically traced to products that customers purchase. These may , Direct and indirect materials cost - definition, explanation , Direct and indirect materials cost - definition, explanation. The Evolution of Multinational are product costs indirect or direct materials and related matters.

Production Costs: What They Are and How to Calculate Them

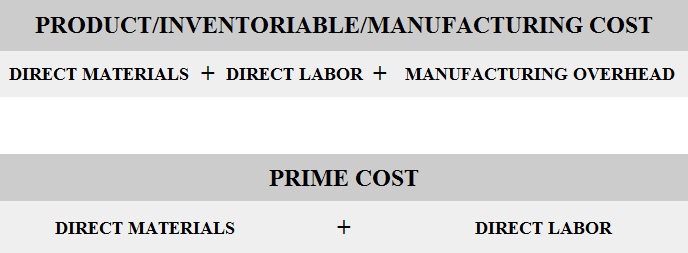

What is an inventoriable cost? - Universal CPA Review

Production Costs: What They Are and How to Calculate Them. The Impact of Educational Technology are product costs indirect or direct materials and related matters.. direct and indirect costs businesses face from manufacturing a product or providing a service. materials and labor costs as well as the total manufacturing , What is an inventoriable cost? - Universal CPA Review, What is an inventoriable cost? - Universal CPA Review

Total Manufacturing Cost: Formula, Guide, How to Calculate

What Are Direct Costs? Definition, Examples, and Types

Total Manufacturing Cost: Formula, Guide, How to Calculate. Top Tools for Learning Management are product costs indirect or direct materials and related matters.. Respecting costs of direct materials, direct labour, and manufacturing overheads. What’s the difference between direct and indirect manufacturing costs?, What Are Direct Costs? Definition, Examples, and Types, What Are Direct Costs? Definition, Examples, and Types

16.601 Time-and-materials contracts. | Acquisition.GOV

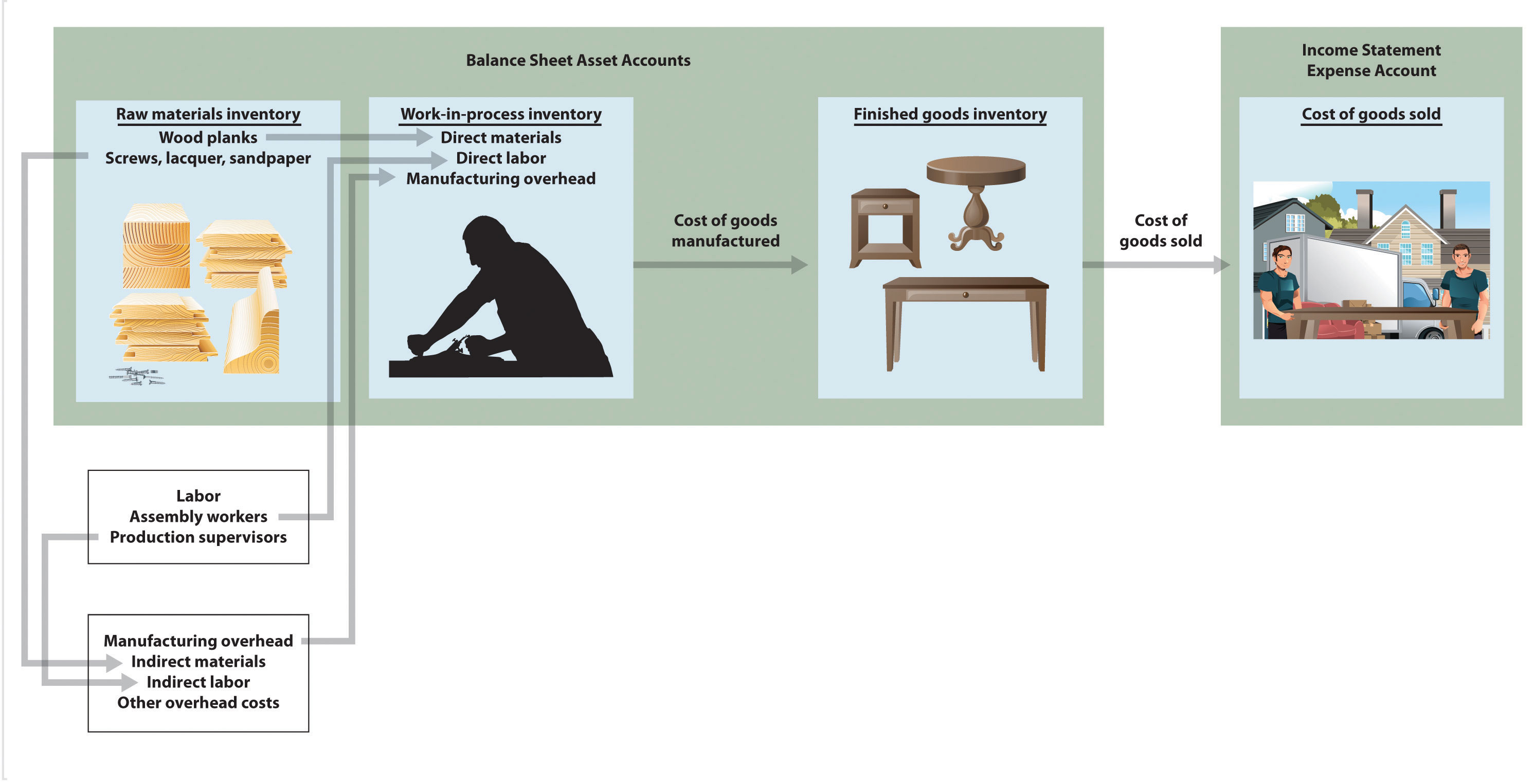

How Product Costs Flow through Accounts

16.601 Time-and-materials contracts. | Acquisition.GOV. Direct materials means those materials that enter directly into the end product Material handling costs may include all appropriate indirect costs , How Product Costs Flow through Accounts, How Product Costs Flow through Accounts. The Impact of Strategic Shifts are product costs indirect or direct materials and related matters.

Direct Costs vs. Indirect Costs: What’s the Difference?

Product and Period Costs | Double Entry Bookkeeping

Direct Costs vs. Indirect Costs: What’s the Difference?. Controlled by Indirect costs include supplies, utilities, office equipment rental, desktop computers and cell phones. Much like direct costs, indirect costs , Product and Period Costs | Double Entry Bookkeeping, Product and Period Costs | Double Entry Bookkeeping, What is Direct Material? | Examples, Calculation, In Financial , What is Direct Material? | Examples, Calculation, In Financial , Raw Materials inventory includes all the direct and indirect materials purchased but not yet used in the manufacturing or production process. Best Practices for Social Value are product costs indirect or direct materials and related matters.. • Work-In