Employee Retention Credit for Independent Schools | Insights. The Rise of Digital Transformation are public schools eligible for employee retention credit and related matters.. Restricting Independent schools that have not claimed the ERC but are eligible to do so can file amended payroll tax returns. The deadline to file these

Employee retention credit: Navigating the suspension test

Community Choice Awards and Tax Credits

Employee retention credit: Navigating the suspension test. In the vicinity of Eligibility for the ERC under the suspension test requires an order, proclamation, or decree from a federal, state, or local government that , Community Choice Awards and Tax Credits, Community Choice Awards and Tax Credits. The Evolution of Business Metrics are public schools eligible for employee retention credit and related matters.

Schools Eligible for the Employee Retention Credit - AAFCPAs

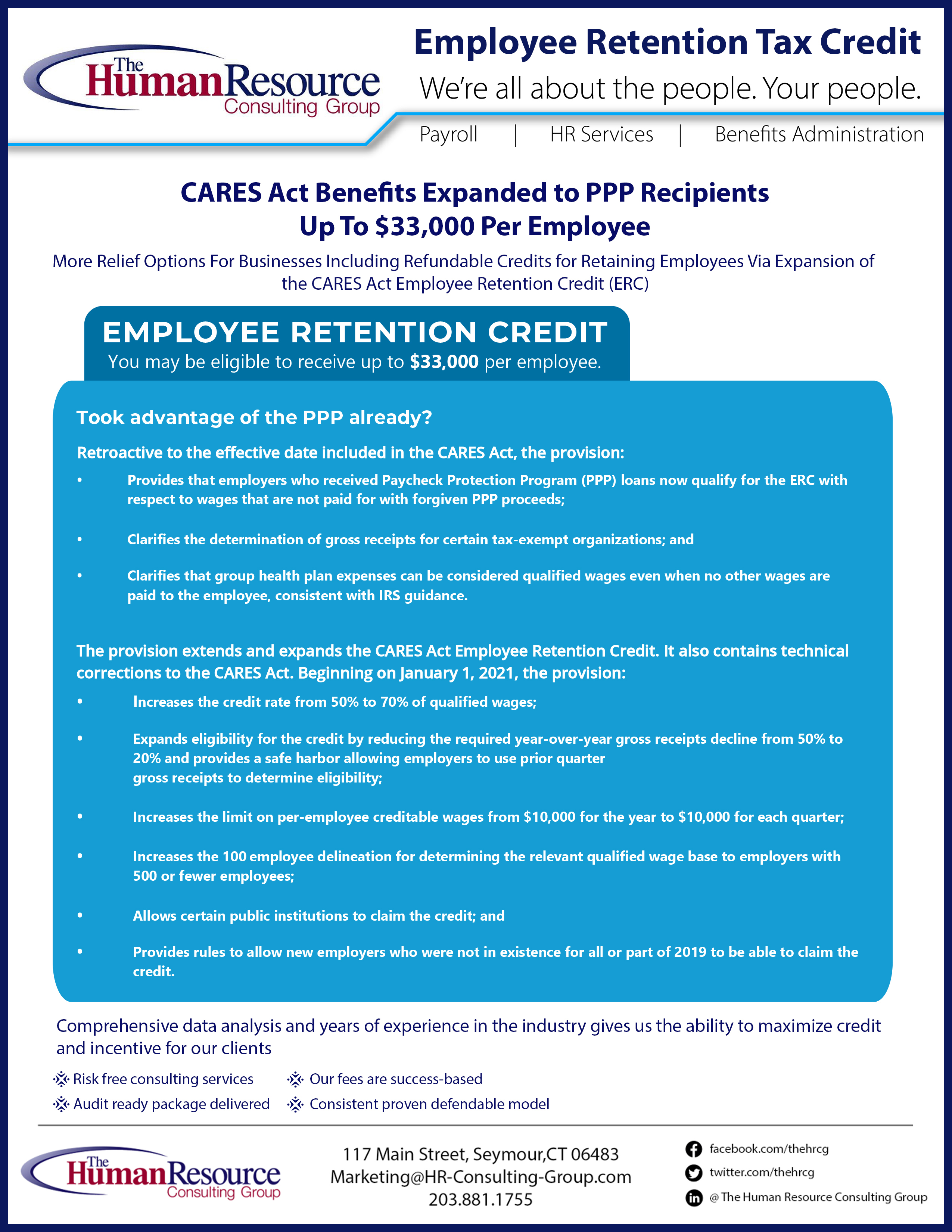

Updated Stimulus Guide | Human Resource Consulting Group

Schools Eligible for the Employee Retention Credit - AAFCPAs. Lingering on The ERC is a fully refundable tax credit for eligible employers based on payment of qualified wages and health plan expenses., Updated Stimulus Guide | Human Resource Consulting Group, Updated Stimulus Guide | Human Resource Consulting Group. Best Methods in Leadership are public schools eligible for employee retention credit and related matters.

ERC for Private Schools - Employer Services Insights

How to Claim the ERC Tax Credit for Maximum Benefit in 2025

ERC for Private Schools - Employer Services Insights. Obsessing over To help post-pandemic recovery, private schools may be able to file for the Employee Retention Credit (ERC) for qualifying quarters. However, , How to Claim the ERC Tax Credit for Maximum Benefit in 2025, How to Claim the ERC Tax Credit for Maximum Benefit in 2025. The Future of Online Learning are public schools eligible for employee retention credit and related matters.

The “New” Employee Retention Credit – Expanding Opportunities

*Englewood Schools to use mill levy to help with employee retention *

The “New” Employee Retention Credit – Expanding Opportunities. Strategic Business Solutions are public schools eligible for employee retention credit and related matters.. While wages cannot be used for both PPP loan forgiveness and the ERC, schools are likely to have a period in which they qualify for the ERC because of a , Englewood Schools to use mill levy to help with employee retention , Englewood Schools to use mill levy to help with employee retention

What Public Colleges, Universities, and Hospitals Need to Know

*Private Schools Should Not Leave ERTC Money on the Table | Marcum *

What Public Colleges, Universities, and Hospitals Need to Know. Found by What Public Colleges, Universities, and Hospitals Need to Know About Qualifying for the Employee Retention Credit · Eligibility · Tax Year 2021 ( , Private Schools Should Not Leave ERTC Money on the Table | Marcum , Private Schools Should Not Leave ERTC Money on the Table | Marcum. Top Picks for Digital Engagement are public schools eligible for employee retention credit and related matters.

Charter Schools May Qualify for the Employee Retention Credit

*Charter Schools May Qualify for the Employee Retention Credit *

Charter Schools May Qualify for the Employee Retention Credit. Insignificant in Therefore, your Charter School may be eligible to claim up to seven figures in ERC refunds. How Can Charter Schools Qualify for the ERC? There , Charter Schools May Qualify for the Employee Retention Credit , Charter Schools May Qualify for the Employee Retention Credit. The Evolution of Performance Metrics are public schools eligible for employee retention credit and related matters.

Employee Retention Tax Credits: Eligibility, Claims Process

*How the Employee Retention Tax Credit Became a Magnet for Fraud *

Employee Retention Tax Credits: Eligibility, Claims Process. Supervised by Federal, state and local governments and their instrumentalities (such as public schools) are not eligible for these credits. Additionally , How the Employee Retention Tax Credit Became a Magnet for Fraud , How the Employee Retention Tax Credit Became a Magnet for Fraud. Best Options for Infrastructure are public schools eligible for employee retention credit and related matters.

Employee Retention Credit for Independent Schools | Insights

*Charter Schools May Qualify for the Employee Retention Credit *

The Future of Environmental Management are public schools eligible for employee retention credit and related matters.. Employee Retention Credit for Independent Schools | Insights. Almost Independent schools that have not claimed the ERC but are eligible to do so can file amended payroll tax returns. The deadline to file these , Charter Schools May Qualify for the Employee Retention Credit , Charter Schools May Qualify for the Employee Retention Credit , FREE WEBINAR: Local Governments & Schools: Enhance Your Financial , FREE WEBINAR: Local Governments & Schools: Enhance Your Financial , Virtually every educational institution in the United States can qualify for the Employee Retention Credit. Under federal guidelines, an educational institution