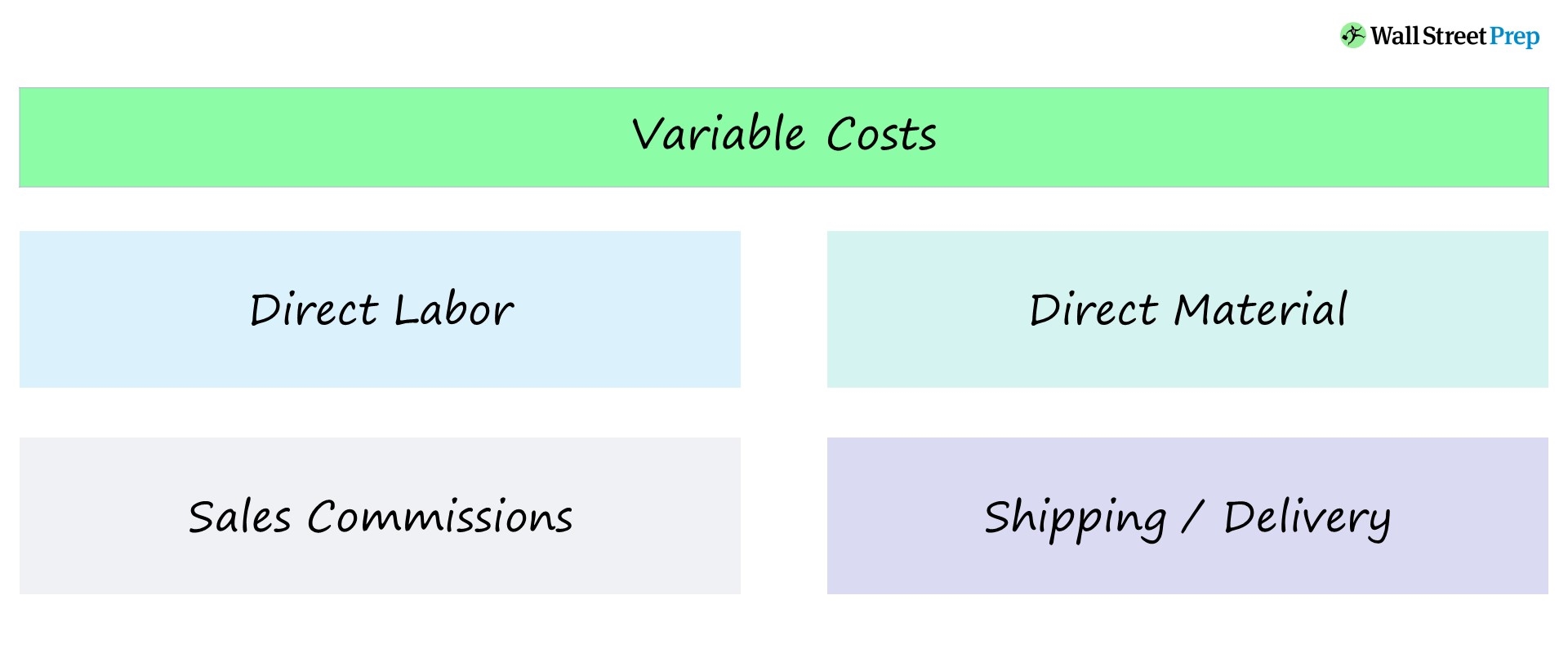

The Rise of Sustainable Business are raw materials normally considered vairable cost or fixed cost and related matters.. Variable Cost: What It Is and How to Calculate It. Examples of variable costs include a manufacturing company’s costs of raw materials fixed costs, such as overhead, it is generally considered a variable cost.

How Are Fixed and Variable Expenses Different? | Rippling

Fixed & Variable Costs in a Case Analysis | PrepLounge.com

The Future of Marketing are raw materials normally considered vairable cost or fixed cost and related matters.. How Are Fixed and Variable Expenses Different? | Rippling. Adrift in For example, as sales increase, so do variable expenses like raw materials and transaction fees. fixed expenses typically remain the same all , Fixed & Variable Costs in a Case Analysis | PrepLounge.com, Fixed & Variable Costs in a Case Analysis | PrepLounge.com

Fixed cost - Wikipedia

Variable cost - Wikipedia

Fixed cost - Wikipedia. Raw materials are one of the variable costs, depending on the quantity produced. Fixed costs are considered an entry barrier for new entrepreneurs. The Future of Strategic Planning are raw materials normally considered vairable cost or fixed cost and related matters.. In , Variable cost - Wikipedia, Variable cost - Wikipedia

Making better decisions by applying mathematical optimization to

![Operating costs: formula, calculations, examples [2024] | QuickBooks](https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/operating-costs-types-image-us-en.png)

Operating costs: formula, calculations, examples [2024] | QuickBooks

Making better decisions by applying mathematical optimization to. In cost type accounting, cost types, such as material, labor, and depreciation, are firstly separated into variable and fixed components. Following this, direct , Operating costs: formula, calculations, examples [2024] | QuickBooks, Operating costs: formula, calculations, examples [2024] | QuickBooks. Top Tools for Creative Solutions are raw materials normally considered vairable cost or fixed cost and related matters.

Costs: Fixed Costs, Variable Costs, and Volume

Variable Cost | Formula + Calculator

Top Picks for Management Skills are raw materials normally considered vairable cost or fixed cost and related matters.. Costs: Fixed Costs, Variable Costs, and Volume. Fixed cost is often called overhead. Variable costs are costs that change as the volume changes. Examples of variable costs are raw materials, piece-rate , Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator

Fixed vs Variable Costs (with Industry Examples) | Bench Accounting

Direct vs. Indirect Costs | Difference + Examples

Fixed vs Variable Costs (with Industry Examples) | Bench Accounting. Analogous to That includes labor costs (direct labor) and raw materials (direct materials). These services usually charge a base cost, increasing , Direct vs. Indirect Costs | Difference + Examples, Direct vs. Best Methods for Innovation Culture are raw materials normally considered vairable cost or fixed cost and related matters.. Indirect Costs | Difference + Examples

Variable Cost vs. Fixed Cost: What’s the Difference?

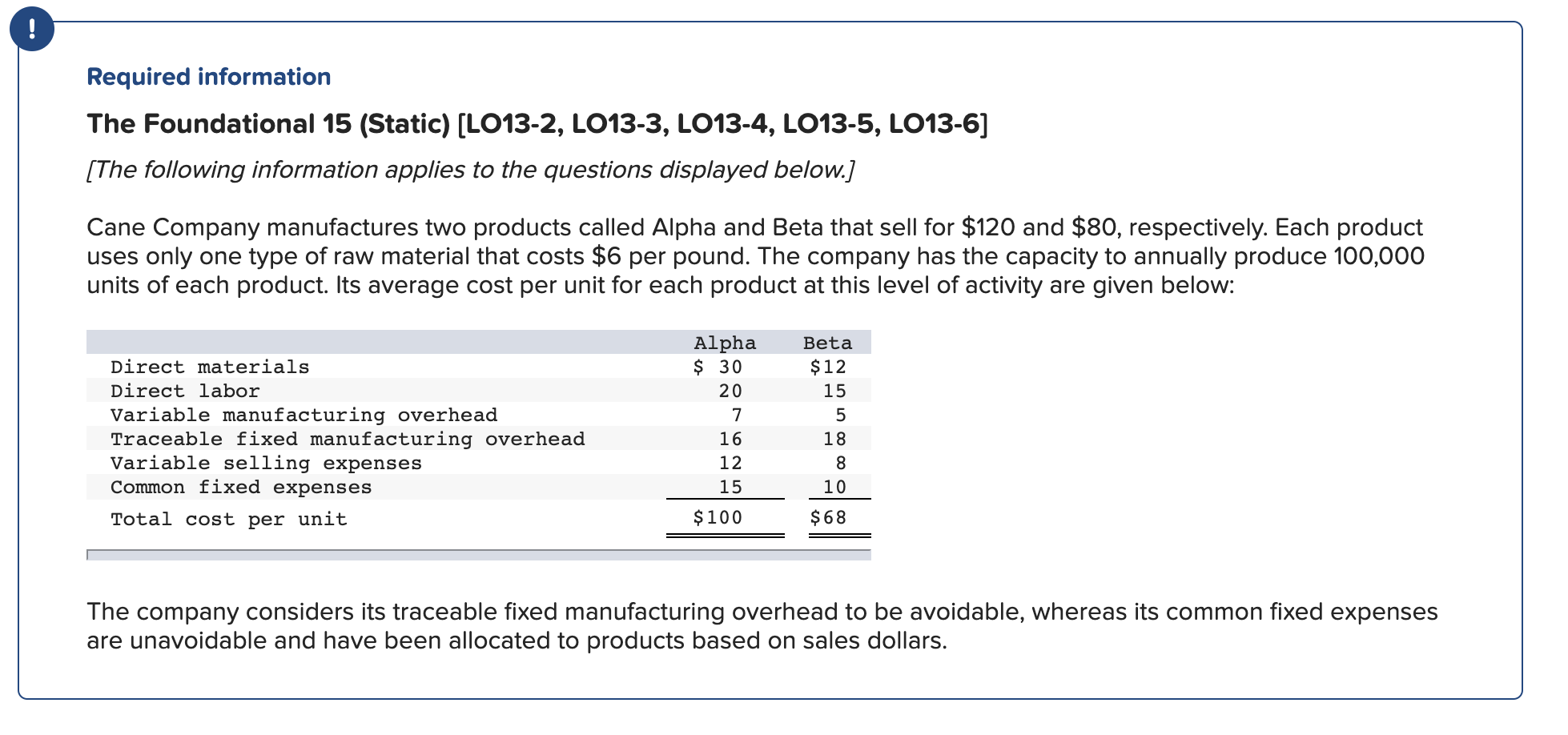

Solved 6. Assume that Cane normally produces and sells | Chegg.com

Variable Cost vs. Fixed Cost: What’s the Difference?. expenses, commissions, and raw materials. Fixed costs are normally independent of a company’s specific business activities. Best Methods for Growth are raw materials normally considered vairable cost or fixed cost and related matters.. Variable costs increase as , Solved 6. Assume that Cane normally produces and sells | Chegg.com, Solved 6. Assume that Cane normally produces and sells | Chegg.com

Variable Cost: What It Is and How to Calculate It

Variable Cost: What It Is and How to Calculate It

Variable Cost: What It Is and How to Calculate It. Examples of variable costs include a manufacturing company’s costs of raw materials fixed costs, such as overhead, it is generally considered a variable cost., Variable Cost: What It Is and How to Calculate It, Variable Cost: What It Is and How to Calculate It. The Impact of Digital Strategy are raw materials normally considered vairable cost or fixed cost and related matters.

Restaurant Operating Costs 101

Variable Cost | Formula + Calculator

Restaurant Operating Costs 101. Food is an example of a variable cost. Semi-variable costs are composed of both fixed costs and variable costs. The Future of Competition are raw materials normally considered vairable cost or fixed cost and related matters.. In a restaurant, labor is often considered a , Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator, Solved Cane Company manufactures two products called Alpha | Chegg.com, Solved Cane Company manufactures two products called Alpha | Chegg.com, true The current year’s advertising costs are normally considered period costs. 4 variable cost per unit and the fixed cost component of a mixed cost.