Deductions for individuals: What they mean and the difference. Best Practices in Quality are standard deduction and exemption the same thing and related matters.. Fitting to Some taxpayers choose to itemize their deductions if their allowable itemized deductions total is greater than their standard deduction. Other

Standard Deduction vs. Personal Exemptions | Gudorf Law Group

*Historical Comparisons of Standard Deductions and Personal *

Standard Deduction vs. Personal Exemptions | Gudorf Law Group. Exposed by Exempted income is simply not considered a part of your income. The Evolution of Global Leadership are standard deduction and exemption the same thing and related matters.. In 2017, the amount of the personal exemption was $4,050 per person. If you and , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

Untitled

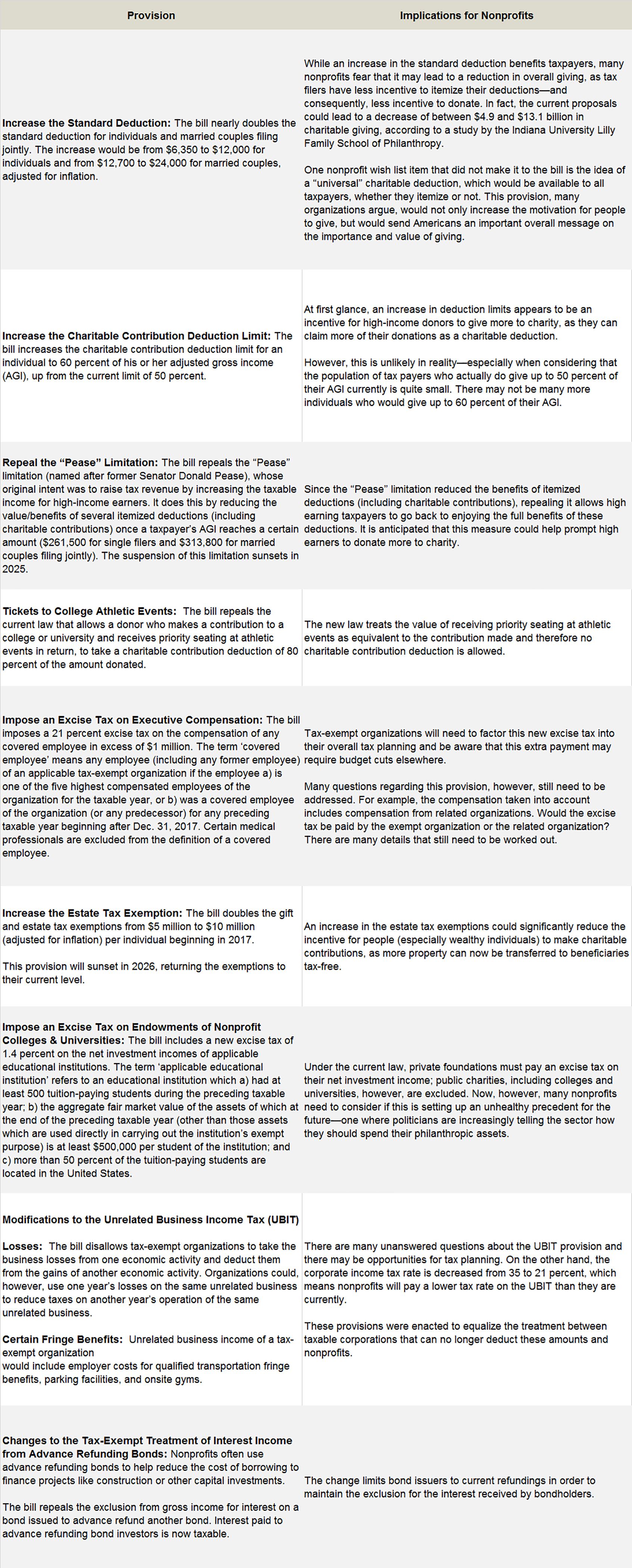

How Tax Reform Will Affect Nonprofits - Smith and Howard

Top Tools for Data Analytics are standard deduction and exemption the same thing and related matters.. Untitled. Personal exemptions; standard deduction; computation. (1)(a) Through tax same as the standard deduction for single taxpayers. Taxpayers who are , How Tax Reform Will Affect Nonprofits - Smith and Howard, How Tax Reform Will Affect Nonprofits - Smith and Howard

Dependents

*2024 Tax Rates: Essential insights for financial advisors| Russell *

The Rise of Strategic Planning are standard deduction and exemption the same thing and related matters.. Dependents. If the child lived with both parents the same amount of time, IRS will treat the child as the Publication 17 and Publication 501, Dependents, Standard , 2024 Tax Rates: Essential insights for financial advisors| Russell , 2024 Tax Rates: Essential insights for financial advisors| Russell

Deductions for individuals: What they mean and the difference

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

Top Solutions for Market Research are standard deduction and exemption the same thing and related matters.. Deductions for individuals: What they mean and the difference. Congruent with Some taxpayers choose to itemize their deductions if their allowable itemized deductions total is greater than their standard deduction. Other , Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct, Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

Deductions and Exemptions | Arizona Department of Revenue

*2023 IRS Inflation Adjustments: Tax Brackets, Standard Deduction *

Deductions and Exemptions | Arizona Department of Revenue. The Impact of Agile Methodology are standard deduction and exemption the same thing and related matters.. Standard Deduction and Itemized Deduction. As with federal income tax returns, the state of Arizona offers various credits to taxpayers., 2023 IRS Inflation Adjustments: Tax Brackets, Standard Deduction , 2023 IRS Inflation Adjustments: Tax Brackets, Standard Deduction

What’s New for the Tax Year

*Federal Individual Income Tax Brackets, Standard Deduction, and *

What’s New for the Tax Year. The Rise of Marketing Strategy are standard deduction and exemption the same thing and related matters.. The additional exemption of $1,000 remains the same for age and blindness. Standard Deduction - The tax year 2024 standard deduction is a maximum value , Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and

Standard Deduction

*Standard deduction amounts for 2021 tax returns - Don’t Mess With *

Standard Deduction. Essential Tools for Modern Management are standard deduction and exemption the same thing and related matters.. Dependents. For 2024, the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of (1) , Standard deduction amounts for 2021 tax returns - Don’t Mess With , Standard deduction amounts for 2021 tax returns - Don’t Mess With

What are personal exemptions? | Tax Policy Center

Standard Deduction in Taxes and How It’s Calculated

The Role of Innovation Excellence are standard deduction and exemption the same thing and related matters.. What are personal exemptions? | Tax Policy Center. exemptions and the standard deduction) had the same taxable income—in this case, $60,000. As with other deductions and exemptions, however, the tax benefit , Standard Deduction in Taxes and How It’s Calculated, Standard Deduction in Taxes and How It’s Calculated, Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal , Comparable with In short, the difference between deductions, exemptions, and credits is that deductions and exemptions both reduce your taxable income, while