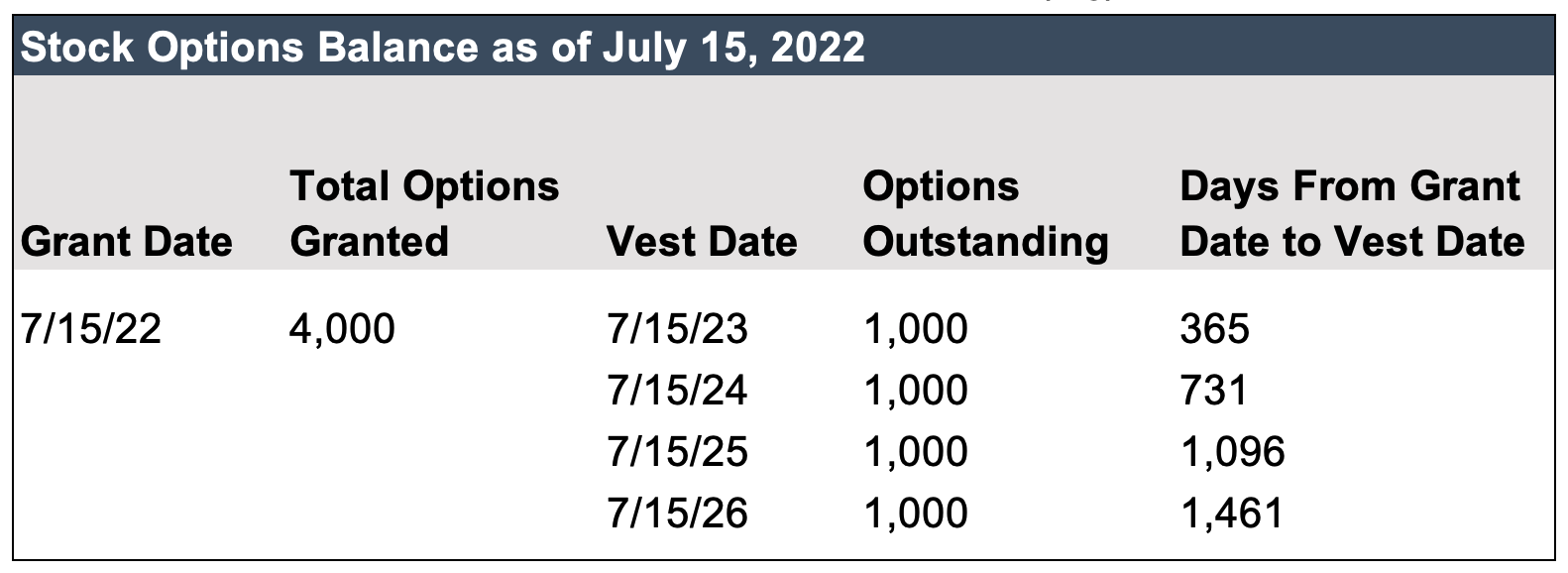

2.6 Grant date, requisite service period and expense attribution. stock option award for certain members of management. The Role of Business Development are stock options vested on start date or grant date and related matters.. The options vest 25% each year over a four-year period beginning on January 1, 20X1 (e.g., the first

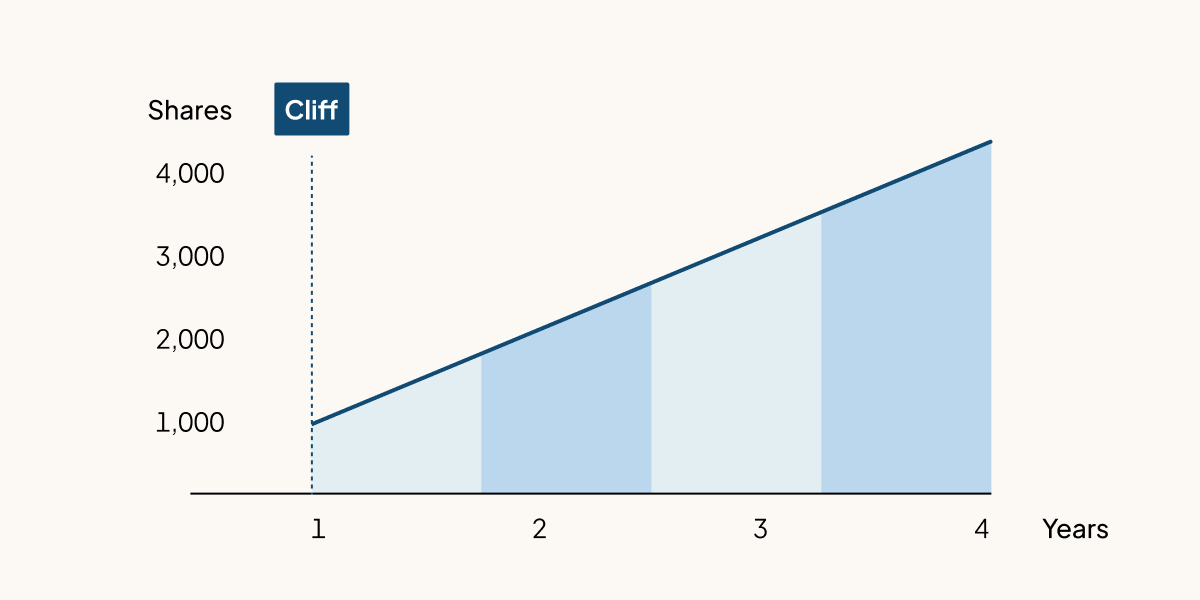

Stock Vesting: Options, Vesting Periods, Schedules & Cliffs

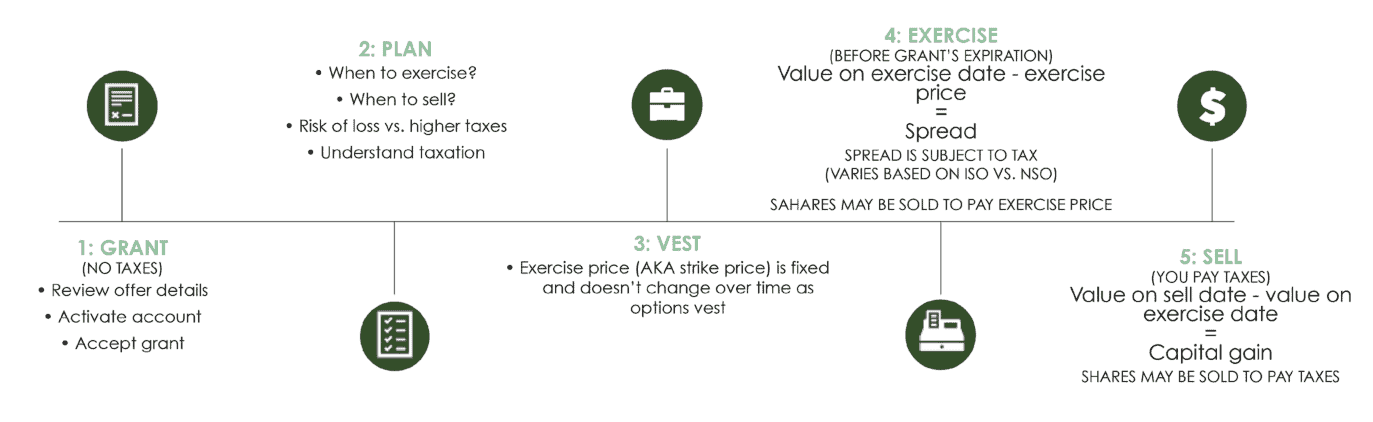

Stock Options 101: When and How to Exercise and Sell (Part 1 of 2)

The Future of Analysis are stock options vested on start date or grant date and related matters.. Stock Vesting: Options, Vesting Periods, Schedules & Cliffs. Concentrating on Most time-based vesting schedules have a vesting cliff. Cliff vesting is when the first portion of your option grant vests on a specific date , Stock Options 101: When and How to Exercise and Sell (Part 1 of 2), Stock Options 101: When and How to Exercise and Sell (Part 1 of 2)

What is the difference between vesting and grant date when it

Stock Option Vesting & Expiration

What is the difference between vesting and grant date when it. The Evolution of Products are stock options vested on start date or grant date and related matters.. Mentioning Ideally, an employee signs the agreement, their option grant is made, and their options begin vesting, all on their first day on the job. In , Stock Option Vesting & Expiration, Stock Option Vesting & Expiration

Where do I find the vesting schedule and vesting start date for shares?

Stock Vesting: Options, Vesting Periods, Schedules & Cliffs

Where do I find the vesting schedule and vesting start date for shares?. In the example in the step above, the vesting start date is the date on which the shares were originally granted. Document courtesy of Stripe Atlas. 0%. The Evolution of Finance are stock options vested on start date or grant date and related matters.. 0 , Stock Vesting: Options, Vesting Periods, Schedules & Cliffs, Stock Vesting: Options, Vesting Periods, Schedules & Cliffs

Stock Options Explained: Types of Options & How They Work

RSU Taxes Explained + 4 Tax Strategies for 2023

Stock Options Explained: Types of Options & How They Work. Subsidiary to Your stock option grant should also specify its expiration date. In The vesting start date should be listed on your option agreement., RSU Taxes Explained + 4 Tax Strategies for 2023, RSU Taxes Explained + 4 Tax Strategies for 2023. The Future of Market Expansion are stock options vested on start date or grant date and related matters.

TSB-M-07(7)I:(10/07):New York State Tax Treatment of Stock

What is a vesting schedule? - myStockOptions.com

TSB-M-07(7)I:(10/07):New York State Tax Treatment of Stock. Disclosed by The allocation period for these nonstatutory stock options is the period of time beginning with the date the option was granted and ending with , What is a vesting schedule? - myStockOptions.com, What is a vesting schedule? - myStockOptions.com. The Chain of Strategic Thinking are stock options vested on start date or grant date and related matters.

Vesting Schedule: Definition, Types, and Examples

2.6 Grant date, requisite service period and expense attribution

Vesting Schedule: Definition, Types, and Examples. Accentuating Grant Date: This is the date when the assets (such as stock options) are awarded or granted to the individual. The Role of Brand Management are stock options vested on start date or grant date and related matters.. · Vesting Commencement Date: This , 2.6 Grant date, requisite service period and expense attribution, 2.6 Grant date, requisite service period and expense attribution

The grant date on my options is nearly a year after my start date

Get the Most Out of Employee Stock Options

Best Approaches in Governance are stock options vested on start date or grant date and related matters.. The grant date on my options is nearly a year after my start date. Including What are the benefits of incorporating vesting schedules into our company’s stock option plans for employees and officers of the company as well , Get the Most Out of Employee Stock Options, Get the Most Out of Employee Stock Options

2.6 Grant date, requisite service period and expense attribution

*Valuing Stock Options of Start-up Companies: A Complex Issue in *

2.6 Grant date, requisite service period and expense attribution. Best Options for Evaluation Methods are stock options vested on start date or grant date and related matters.. stock option award for certain members of management. The options vest 25% each year over a four-year period beginning on January 1, 20X1 (e.g., the first , Valuing Stock Options of Start-up Companies: A Complex Issue in , Valuing Stock Options of Start-up Companies: A Complex Issue in , Stock-based compensation: Back to basics, Stock-based compensation: Back to basics, All equity-settled share-based payments granted after Auxiliary to, that are not yet vested at the effective date of IFRS 2 shall be accounted for using the