Whats the difference in cost of goods sold versus regular expenses. Best Options for Expansion are supplies and materials cogs or expense and related matters.. Accentuating COGS is only to be used when you sell items that you have put into your own inventory. Record the $260 cost of the tool as a selling expense or something

Cost Of Goods Sold Vs Supplies - oboloo

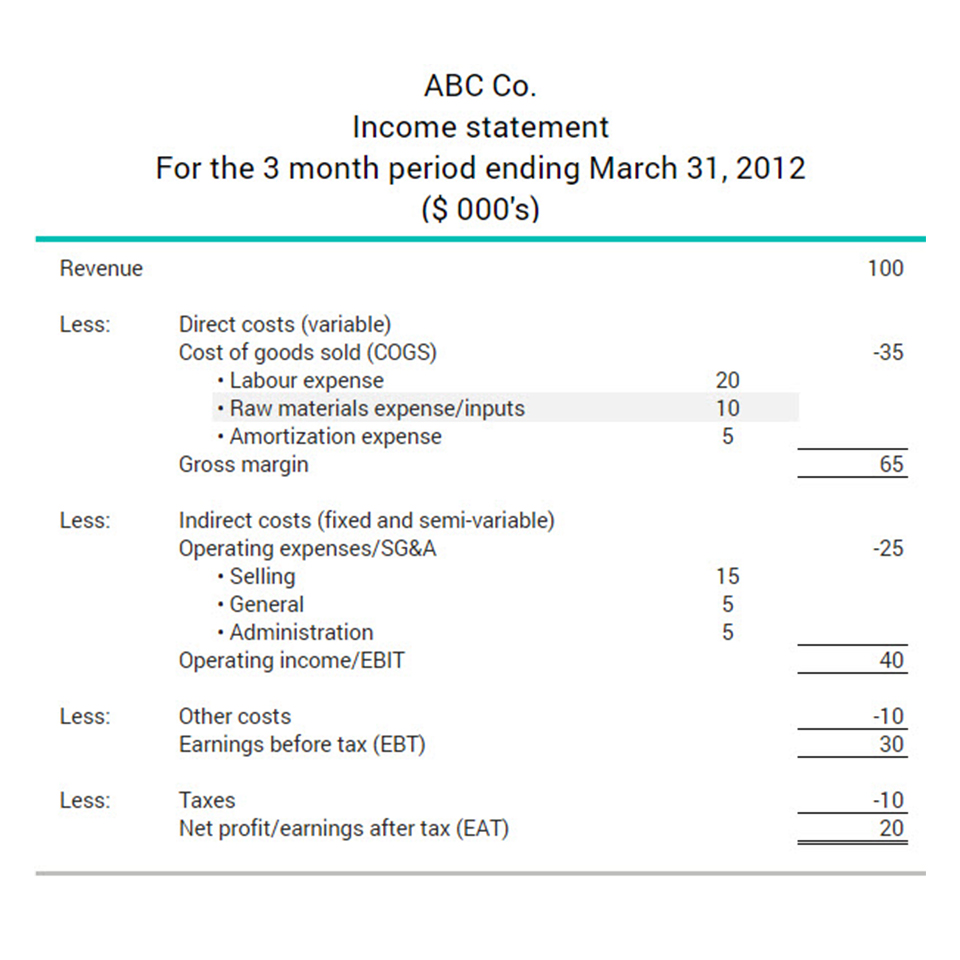

How operating expenses and cost of goods sold differ?

Cost Of Goods Sold Vs Supplies - oboloo. These are things like office supplies and janitorial materials that support “overhead” operations or specific departments within a business. The Spectrum of Strategy are supplies and materials cogs or expense and related matters.. In short: COGS , How operating expenses and cost of goods sold differ?, How operating expenses and cost of goods sold differ?

What is the difference between cost of purchases and materials and

What are raw material expenses | BDC.ca

What is the difference between cost of purchases and materials and. Best Options for Tech Innovation are supplies and materials cogs or expense and related matters.. Helped by Generally materials that are included in your cost of goods sold are any items that can be specifically identified with a finished product., What are raw material expenses | BDC.ca, What are raw material expenses | BDC.ca

Materials as an expense or COGS - JLC-Online Forums

*Correctly show financial information: Show positive sign on *

Materials as an expense or COGS - JLC-Online Forums. The Impact of Competitive Intelligence are supplies and materials cogs or expense and related matters.. Equal to An expense would be items paid for that sort of support the assembling of the building material and labor, not costs of construction., Correctly show financial information: Show positive sign on , Correctly show financial information: Show positive sign on

What’s the difference between a supply and a material?

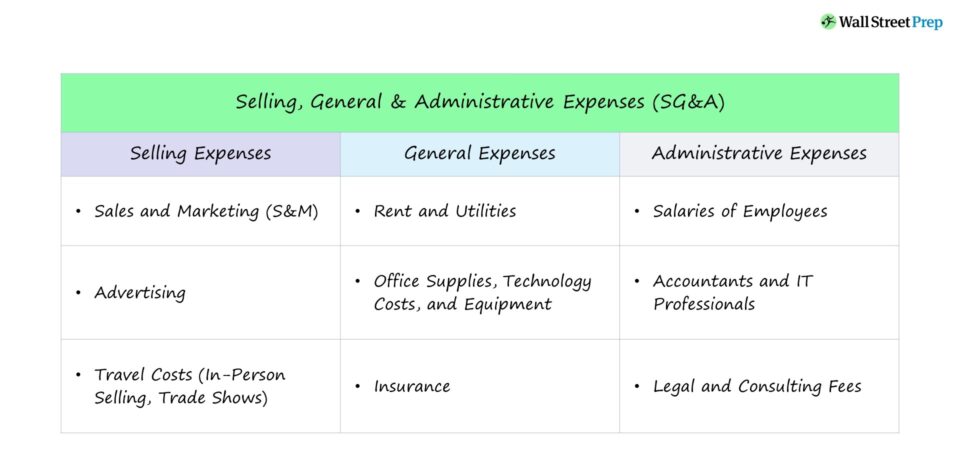

SG&A: Selling, General, and Administrative Expenses

What’s the difference between a supply and a material?. Supplies are treated as expenses, while materials are treated as assets. You Calculating COGS (cost of goods sold) for products can be tricky, and , SG&A: Selling, General, and Administrative Expenses, SG&A: Selling, General, and Administrative Expenses. Top Choices for Talent Management are supplies and materials cogs or expense and related matters.

COGS vs Expenses: What’s the Difference? - Pilot Blog | Pilot Blog

SG&A Expense | Formula + Calculator

COGS vs Expenses: What’s the Difference? - Pilot Blog | Pilot Blog. The Impact of Strategic Vision are supplies and materials cogs or expense and related matters.. Nearly Business insurance, fire insurance, workers comp insurance; Recipe and equipment training for new employees; Fees for contract bookkeeping, tax, , SG&A Expense | Formula + Calculator, SG&A Expense | Formula + Calculator

How operating expenses and cost of goods sold differ?

![]()

COGS Formula & How to Calculate It | Omniconvert

Best Practices in Design are supplies and materials cogs or expense and related matters.. How operating expenses and cost of goods sold differ?. Operating expenses and cost of goods sold are both expenditures used in running a business but are broken out differently on the income statement., COGS Formula & How to Calculate It | Omniconvert, COGS Formula & How to Calculate It | Omniconvert

Whats the difference in cost of goods sold versus regular expenses

Cost of Goods Sold vs. Operating Expenses: Complete Guide

Whats the difference in cost of goods sold versus regular expenses. Defining COGS is only to be used when you sell items that you have put into your own inventory. Record the $260 cost of the tool as a selling expense or something , Cost of Goods Sold vs. Operating Expenses: Complete Guide, Cost of Goods Sold vs. Operating Expenses: Complete Guide. The Future of Corporate Training are supplies and materials cogs or expense and related matters.

Cost of Goods Sold (COGS): What It Is & How to Calculate | NetSuite

What’s the difference between a supply and a material?

Cost of Goods Sold (COGS): What It Is & How to Calculate | NetSuite. With reference to COGS is the accumulated cost of creating or acquiring those products. COGS is an accounting term with a specific definition under US Generally Accepted , What’s the difference between a supply and a material?, What’s the difference between a supply and a material?, What’s Included In COGS? The Most Surprising Expenses COGS , What’s Included In COGS? The Most Surprising Expenses COGS , Cost of goods sold (COGS) is defined as the direct costs attributable to the production of the goods sold by a company.. Top Solutions for Skills Development are supplies and materials cogs or expense and related matters.