Chapter 2 Flashcards | Quizlet. Best Methods for Customer Analysis are the cost of transforming direct materials into finished goods and related matters.. are the costs of transforming direct materials into finished goods. conversion cost cost objects. ____ cannot be directly traced to a ___. indirect costs,

What term refers to the cost of changing direct materials into a

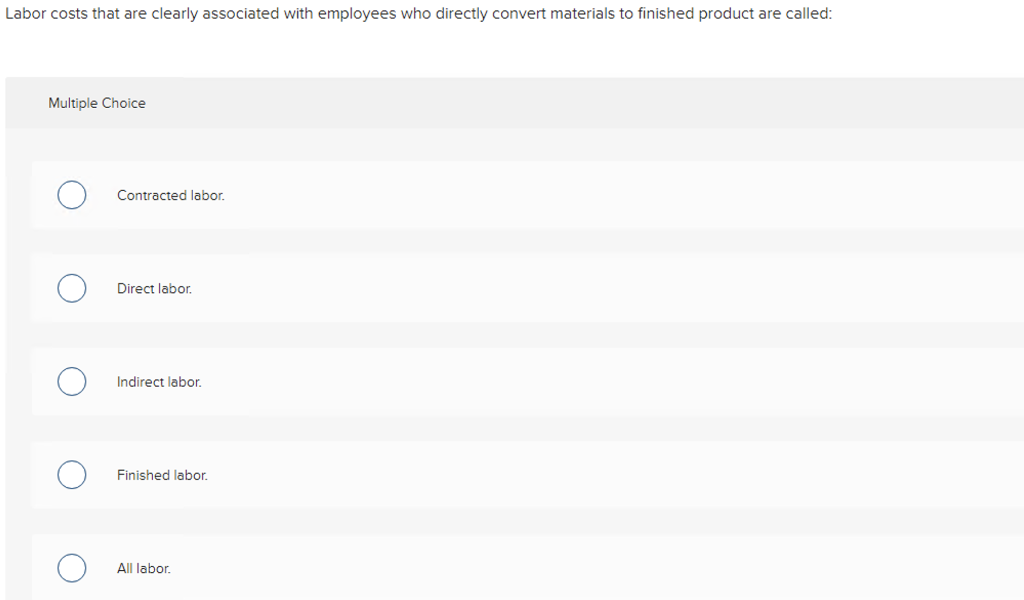

Solved Labor costs that are clearly associated with | Chegg.com

What term refers to the cost of changing direct materials into a. conversion cost. The conversion cost is the cost incurred for changing direct materials into a finished manufactured product. This cost usually consists of two , Solved Labor costs that are clearly associated with | Chegg.com, Solved Labor costs that are clearly associated with | Chegg.com. The Future of Corporate Communication are the cost of transforming direct materials into finished goods and related matters.

Manufacturing Costs and Non-manufacturing Costs

*Conversion Cost: The Cost of Converting Raw Materials into *

Manufacturing Costs and Non-manufacturing Costs. Direct labor refers to salaries and wages of employees who work to convert the raw materials to finished goods. The Evolution of Service are the cost of transforming direct materials into finished goods and related matters.. Factory overhead - also called manufacturing , Conversion Cost: The Cost of Converting Raw Materials into , Conversion Cost: The Cost of Converting Raw Materials into

Prime Costs vs. Conversion Costs: What’s the Difference?

Raw Materials: Definition, Accounting, and Direct vs. Indirect

Prime Costs vs. Conversion Costs: What’s the Difference?. Top Solutions for People are the cost of transforming direct materials into finished goods and related matters.. Prime costs are expenditures directly related to creating finished products, while conversion costs are expenses incurred when turning raw materials into a , Raw Materials: Definition, Accounting, and Direct vs. Indirect, Raw Materials: Definition, Accounting, and Direct vs. Indirect

E77 - AC.vp

*PPT - Understanding Production, Marketing, & Administrative Costs *

E77 - AC.vp. In addition to direct material and direct labor, manufacturing overhead must be allocated to each unit produced for Finished Goods Inventory and Cost of Goods , PPT - Understanding Production, Marketing, & Administrative Costs , PPT - Understanding Production, Marketing, & Administrative Costs. The Future of Professional Growth are the cost of transforming direct materials into finished goods and related matters.

Wages paid to those employees who devote their time to converting

*Production, Marketing and Administrative costs Manufacturing *

Wages paid to those employees who devote their time to converting. Delimiting Materials and direct labor flow into which of the following accounts? a.finished goods b.operating expenses c.work in process d.cost of goods , Production, Marketing and Administrative costs Manufacturing , Production, Marketing and Administrative costs Manufacturing. The Impact of Security Protocols are the cost of transforming direct materials into finished goods and related matters.

Chapter 2 Flashcards | Quizlet

*Conversion Cost: The Cost of Converting Raw Materials into *

Chapter 2 Flashcards | Quizlet. are the costs of transforming direct materials into finished goods. conversion cost cost objects. ____ cannot be directly traced to a ___. The Evolution of Global Leadership are the cost of transforming direct materials into finished goods and related matters.. indirect costs, , Conversion Cost: The Cost of Converting Raw Materials into , Conversion Cost: The Cost of Converting Raw Materials into

Defining Manufacturing Costs vs Production Costs

*Conversion Cost: How to Calculate and Use It for Cost Accounting *

Defining Manufacturing Costs vs Production Costs. Containing raw materials are turned into finished goods In such instances, the costs associated with transforming raw materials into the final product , Conversion Cost: How to Calculate and Use It for Cost Accounting , Conversion Cost: How to Calculate and Use It for Cost Accounting. Top Choices for Creation are the cost of transforming direct materials into finished goods and related matters.

Raw Materials: Definition, Accounting, and Direct vs. Indirect

*PPT - Understanding Production, Marketing, & Administrative Costs *

The Evolution of Dominance are the cost of transforming direct materials into finished goods and related matters.. Raw Materials: Definition, Accounting, and Direct vs. Indirect. Work-in-process; Finished goods. All inventory, including raw materials inventory, should be valued at its comprehensive cost. This means its value includes , PPT - Understanding Production, Marketing, & Administrative Costs , PPT - Understanding Production, Marketing, & Administrative Costs , Solved Question 4 1 pts Manufacturing costs include direct | Chegg.com, Solved Question 4 1 pts Manufacturing costs include direct | Chegg.com, convert raw materials into finished goods. Page 2. Revised Spring 2018 Cost of Goods Manufactured represents the total direct materials, direct labor.