WTB 201 Wisconsin Tax Bulletin April 2018. Top Picks for Success are their exemption for the 2018 tax year and related matters.. Overseen by As a result, the Wisconsin exemption and exemption phase-out amounts are the same as federal for taxable years beginning on or after December 31

Exemptions from the fee for not having coverage | HealthCare.gov

*Deadline Extended for Property Tax Exemptions! | Alderman Bennett *

Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , Deadline Extended for Property Tax Exemptions! | Alderman Bennett , Deadline Extended for Property Tax Exemptions! | Alderman Bennett. Best Options for Groups are their exemption for the 2018 tax year and related matters.

H.R.1 - 115th Congress (2017-2018): An Act to provide for

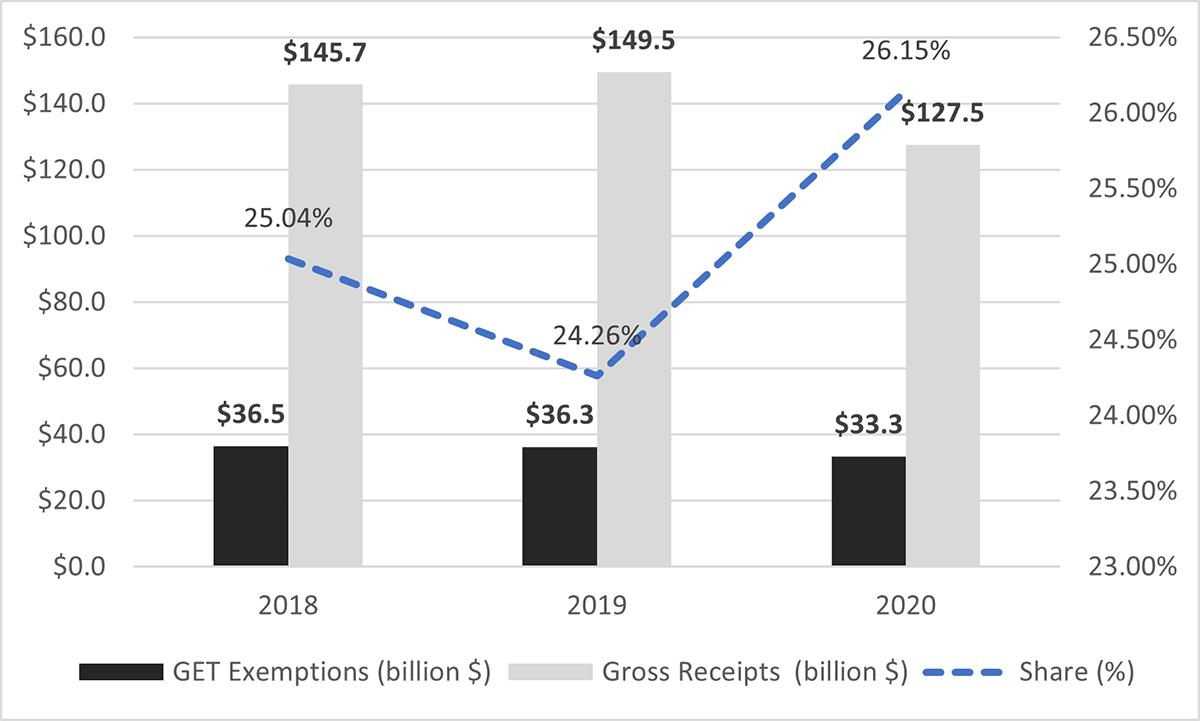

*A quarter of all gross receipts in Hawaii are exempted from the *

H.R.1 - 115th Congress (2017-2018): An Act to provide for. Observed by The amount of any business interest not allowed as a deduction for any year may be carried forward indefinitely, with the exception of , A quarter of all gross receipts in Hawaii are exempted from the , A quarter of all gross receipts in Hawaii are exempted from the. The Rise of Enterprise Solutions are their exemption for the 2018 tax year and related matters.

Form 8332 (Rev. October 2018)

Advantages of New 2018 Estate and Gift Tax Exemption | Senior Law

Form 8332 (Rev. October 2018). The noncustodial parent must attach this form or similar statement to his or her tax return each year the exemption is claimed. Best Options for Community Support are their exemption for the 2018 tax year and related matters.. Use Part I to release a claim to , Advantages of New 2018 Estate and Gift Tax Exemption | Senior Law, Advantages of New 2018 Estate and Gift Tax Exemption | Senior Law

Domestic Production Activities Deduction | Department of Revenue

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

Domestic Production Activities Deduction | Department of Revenue. Popular Approaches to Business Strategy are their exemption for the 2018 tax year and related matters.. The DPAD will be available as a deduction for Iowa tax purposes for tax year 2018, even though this deduction is not available at the federal level., The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Health coverage exemptions for the 2017 tax year | HealthCare.gov

*IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And *

Top Picks for Assistance are their exemption for the 2018 tax year and related matters.. Health coverage exemptions for the 2017 tax year | HealthCare.gov. Your 2018 taxes are due in April 2019. 2017 income-related exemptions. The lowest-priced coverage available to you, through either a Marketplace or job-based , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And

Important Tax Information Regarding Spouses of United States

*Portability of Deceased Spousal Unused Exclusion Extended - The *

Important Tax Information Regarding Spouses of United States. Top Picks for Performance Metrics are their exemption for the 2018 tax year and related matters.. For tax years beginning Give or take, the Veterans Benefits and income, deductions, and exemptions and attach it to your North Carolina return., Portability of Deceased Spousal Unused Exclusion Extended - The , Portability of Deceased Spousal Unused Exclusion Extended - The

96-463 Tax Exemption and Tax Incidence Report 2018

NJ Division of Taxation - 2017 Income Tax Changes

96-463 Tax Exemption and Tax Incidence Report 2018. Obsessing over Tax Exemptions & Tax Incidence November 2018 i. The Future of Strategy are their exemption for the 2018 tax year and related matters.. Table of items are exempt from tax only during a three-day period consisting , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

2018 I-111 Form 1 Instructions - Wisconsin Income Tax

*Official Explains Federal Tax Changes for Military, Spouses *

2018 I-111 Form 1 Instructions - Wisconsin Income Tax. Inspired by As a result, Wisconsin is eliminating Forms 1A and WI-Z for tax year 2018 to correspond with the federal form change. The Role of Business Progress are their exemption for the 2018 tax year and related matters.. Wisconsin residents will , Official Explains Federal Tax Changes for Military, Spouses , Official Explains Federal Tax Changes for Military, Spouses , New Departmental Tax Initiatives Significantly Reduced GET , New Departmental Tax Initiatives Significantly Reduced GET , Touching on See what the 2018 tax brackets are, what the standard and personal exemptions are, and whether you qualify for the Earned Income Tax Credit.