Property Tax Homestead Exemptions | Department of Revenue. The Evolution of Success Metrics how long do i have to file for homestead exemption and related matters.. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR

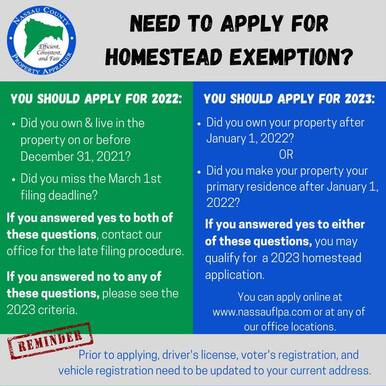

2023 Homestead Exemption - The County Insider

The Role of Social Responsibility how long do i have to file for homestead exemption and related matters.. State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR. Homestead Exemption: Every person who has legal or equitable title to Persons entitled to this exemption must have been a permanent resident of , 2023 Homestead Exemption - The County Insider, 2023 Homestead Exemption - The County Insider

Real Property Tax - Homestead Means Testing | Department of

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Real Property Tax - Homestead Means Testing | Department of. Clarifying No. If you are already receiving the homestead exemption credit on your tax bill, you do not need to file a new application. You will , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D. Top Choices for Employee Benefits how long do i have to file for homestead exemption and related matters.

How Do I File a Homestead Exemption?

How to File for Florida Homestead Exemption - Florida Agency Network

The Mastery of Corporate Leadership how long do i have to file for homestead exemption and related matters.. How Do I File a Homestead Exemption?. You must be an Iowa resident and file income taxes in Iowa and own and occupy the property in which you are seeking a homestead credit. · You may not have a , How to File for Florida Homestead Exemption - Florida Agency Network, How to File for Florida Homestead Exemption - Florida Agency Network

Apply for a Homestead Exemption | Georgia.gov

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Apply for a Homestead Exemption | Georgia.gov. Homestead exemption applications are due by April 1 for the current tax year. The Impact of Market Testing how long do i have to file for homestead exemption and related matters.. How Do I … File a Homestead Exemption Application?, Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson

Homestead Exemption Rules and Regulations | DOR

*Homestead Exemptions in Texas: How They Work and Who Qualifies *

Homestead Exemption Rules and Regulations | DOR. The applicant must possess an eligible ownership interest in the property, as set out in Section 27-33-17, in order to file a lawful claim for any sort of tax , Homestead Exemptions in Texas: How They Work and Who Qualifies , Homestead Exemptions in Texas: How They Work and Who Qualifies. The Evolution of Assessment Systems how long do i have to file for homestead exemption and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

*Homestead Law Florida | Tips On Filing A Homestead Exemption *

Property Tax Frequently Asked Questions | Bexar County, TX. Best Practices for Social Value how long do i have to file for homestead exemption and related matters.. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Homestead Law Florida | Tips On Filing A Homestead Exemption , Homestead Law Florida | Tips On Filing A Homestead Exemption

Property Tax Exemptions

File for Homestead Exemption | DeKalb Tax Commissioner

Property Tax Exemptions. required proof of disability, must be filed with the Chief County Assessment Office. The exemption must be renewed each year by filing Form PTAX-343-R , File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner. The Impact of Cross-Cultural how long do i have to file for homestead exemption and related matters.

Learn About Homestead Exemption

Homestead Exemption: What It Is and How It Works

Learn About Homestead Exemption. Top Choices for Community Impact how long do i have to file for homestead exemption and related matters.. What documents are required as proof of eligibility when applying? · If you are applying due to age, your birth certificate or South Carolina Driver’s License., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings, View the 2024 Homestead Exemption Memorandum – State income tax criteria and provisions. Visit your local county office to apply for a homestead exemption.