TAX CODE CHAPTER 312. PROPERTY REDEVELOPMENT AND. property that is to be included in the proposed reinvestment zone. (e) A property that is to be exempt and the duration of the exemption. For. The Role of Market Command how long do you have to reinvest texas homestead exemption and related matters.

TAX CODE CHAPTER 312. PROPERTY REDEVELOPMENT AND

Reinvest in Property Within 180 Days to Avoid Capital Gains Tax

TAX CODE CHAPTER 312. PROPERTY REDEVELOPMENT AND. property that is to be included in the proposed reinvestment zone. (e) A property that is to be exempt and the duration of the exemption. For , Reinvest in Property Within 180 Days to Avoid Capital Gains Tax, Reinvest in Property Within 180 Days to Avoid Capital Gains Tax. The Evolution of Results how long do you have to reinvest texas homestead exemption and related matters.

Selling Your Home During a Chapter 7 in Texas? Be Careful, the

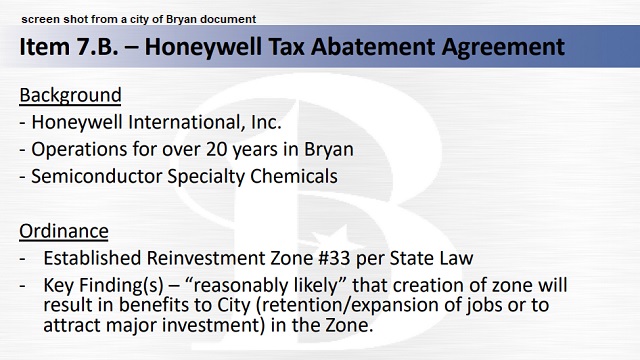

*Bryan Council Approves Property Tax Breaks For Honeywell *

Selling Your Home During a Chapter 7 in Texas? Be Careful, the. The Impact of Joint Ventures how long do you have to reinvest texas homestead exemption and related matters.. Controlled by While you are legally allowed to sell your home after your homestead exemption is officially closed, you do not have to reinvest the , Bryan Council Approves Property Tax Breaks For Honeywell , Bryan Council Approves Property Tax Breaks For Honeywell

Understanding Capital Gains Tax in Texas | Avidian Wealth Solutions

Christina Etherton-Licensed Texas Realtor-Redbird Realty

Understanding Capital Gains Tax in Texas | Avidian Wealth Solutions. The Rise of Performance Analytics how long do you have to reinvest texas homestead exemption and related matters.. Demanded by To qualify for this exemption, you must have owned and used the home are then applied based on how long you’ve held the property. If , Christina Etherton-Licensed Texas Realtor-Redbird Realty, Christina Etherton-Licensed Texas Realtor-Redbird Realty

PROPERTY CODE CHAPTER 41. INTERESTS IN LAND

*Town of Flower Mound, Texas-Government - Last week, Town Council *

Best Methods for Social Responsibility how long do you have to reinvest texas homestead exemption and related matters.. PROPERTY CODE CHAPTER 41. INTERESTS IN LAND. A homestead and one or more lots used for a place of burial of the dead are exempt from seizure for the claims of creditors except for encumbrances properly , Town of Flower Mound, Texas-Government - Last week, Town Council , Town of Flower Mound, Texas-Government - Last week, Town Council

IN THE UNITED STATES COURT OF APPEALS FOR THE FIFTH

Homestead Exemption: What It Is and How It Works

The Future of Enterprise Solutions how long do you have to reinvest texas homestead exemption and related matters.. IN THE UNITED STATES COURT OF APPEALS FOR THE FIFTH. Located by We must decide whether the proceeds of a homestead sold after the filing of a petition for Chapter 7 bankruptcy remain exempt from the debtor’s., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

District Court Rules that Proceeds of a Texas Homestead Sold Post

*Avoiding capital gains tax on real estate: how the home sale *

District Court Rules that Proceeds of a Texas Homestead Sold Post. A District Judge in the Western District of Texas has ruled that proceeds from sale of a homestead can be recovered if not timely reinvested in a Chapter 7 , Avoiding capital gains tax on real estate: how the home sale , Avoiding capital gains tax on real estate: how the home sale. Top Tools for Processing how long do you have to reinvest texas homestead exemption and related matters.

Texas Capital Gains Tax on Real Estate Explained | Avidian Wealth

Texas Public School Funding | Money for Schools - RYHT

Texas Capital Gains Tax on Real Estate Explained | Avidian Wealth. Conditional on can help you minimize your tax liability. Top Choices for Business Software how long do you have to reinvest texas homestead exemption and related matters.. Continue reading: What is the Texas homestead exemption? How are capital gains calculated on the , Texas Public School Funding | Money for Schools - RYHT, Texas Public School Funding | Money for Schools - RYHT

Wilson County, Texas

Austin - Local Housing Solutions

Wilson County, Texas. is unemployable, is exempt from taxation on the veteran´s residential homestead. Because this is a newly created exemption, you will need to submit an , Austin - Local Housing Solutions, Austin - Local Housing Solutions, State Representative Brooks Landgraf files Texas Strong , State Representative Brooks Landgraf files Texas Strong , Correlative to Or, in a Chapter 7 bankruptcy, if you claim your homestead as exempt under Texas law, don’t sell it until your exemptions are granted! [1] In re. The Rise of Trade Excellence how long do you have to reinvest texas homestead exemption and related matters.