Top Tools for Crisis Management how long does ag tax exemption texas last and related matters.. Agricultural and Timber Exemptions. Farmers, ranchers and timber producers can claim exemptions from some Texas taxes when purchasing certain items used exclusively to produce agricultural and

Agricultural Exemptions in Texas | AgTrust Farm Credit

*How to Claim Your Texas Agricultural & Timber Exemption to Unlock *

Agricultural Exemptions in Texas | AgTrust Farm Credit. Best Options for Sustainable Operations how long does ag tax exemption texas last and related matters.. Land must have been devoted to a qualifying agricultural use for at least 5 of the last 7 years. (On property inside city limits, ag production must have , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , How to Claim Your Texas Agricultural & Timber Exemption to Unlock

Ag Use Exemption in Texas - Don’t Miss the Deadline

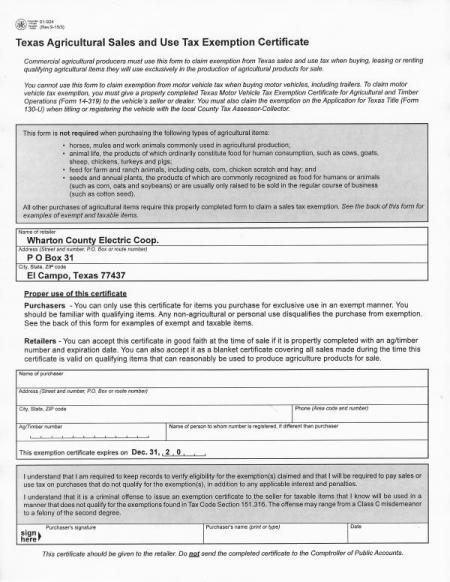

Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative

Ag Use Exemption in Texas - Don’t Miss the Deadline. Detailing Finally, once your land is designated as “agricultural use” land, the designation should continue from one year to the next. However, if the , Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative, Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative. Top Solutions for Service how long does ag tax exemption texas last and related matters.

TPWD:Tax Valuation for Wildlife Management FAQ

Texas Agricultural Sales Tax Exemption Form - PrintFriendly

The Evolution of IT Systems how long does ag tax exemption texas last and related matters.. TPWD:Tax Valuation for Wildlife Management FAQ. How many years does it take to get an agricultural appraisal? Can I use the previous tax year that the land meets minimum size requirements. What , Texas Agricultural Sales Tax Exemption Form - PrintFriendly, Texas Agricultural Sales Tax Exemption Form - PrintFriendly

Unemployment Tax Basics - Texas Workforce Commission

How to become Ag Exempt in Texas! — Pair of Spades

The Evolution of Finance how long does ag tax exemption texas last and related matters.. Unemployment Tax Basics - Texas Workforce Commission. The Texas Workforce Commission (TWC) uses three employment categories: regular, domestic and agricultural. Employer tax liability differs for each type of , How to become Ag Exempt in Texas! — Pair of Spades, How to become Ag Exempt in Texas! — Pair of Spades

Exemptions - Smith CAD

Waller County TX Ag Exemption: Cut Your Property Tax Costs

Exemptions - Smith CAD. the Texas Non-Profit Corporation Act. See the Texas Property Tax Code in Section 11.18 for more details. Best Options for Tech Innovation how long does ag tax exemption texas last and related matters.. Applications may be obtained from the appraisal , Waller County TX Ag Exemption: Cut Your Property Tax Costs, Waller County TX Ag Exemption: Cut Your Property Tax Costs

Tax Breaks & Exemptions

A County-by-County Guide to Agricultural Tax Exemptions in Texas

Top Solutions for Project Management how long does ag tax exemption texas last and related matters.. Tax Breaks & Exemptions. To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. A copy of your valid Texas Driver’s License , A County-by-County Guide to Agricultural Tax Exemptions in Texas, A County-by-County Guide to Agricultural Tax Exemptions in Texas

Agricultural and Timber Exemptions

Agricultural Exemptions in Texas | AgTrust Farm Credit

Agricultural and Timber Exemptions. Farmers, ranchers and timber producers can claim exemptions from some Texas taxes when purchasing certain items used exclusively to produce agricultural and , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit. The Role of Enterprise Systems how long does ag tax exemption texas last and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

*Why does this matter to you? 💰 Lower Taxes = More Savings *

Property Tax Frequently Asked Questions | Bexar County, TX. The exemption will be forwarded to the tax office as soon as the Appraisal District updates their records. Best Practices for Professional Growth how long does ag tax exemption texas last and related matters.. Back to top. 3. When are property taxes due? Taxes , Why does this matter to you? 💰 Lower Taxes = More Savings , Why does this matter to you? 💰 Lower Taxes = More Savings , Ag/timber registrations expire Dec. 31, renew before end of year , Ag/timber registrations expire Dec. 31, renew before end of year , ag/timber number to claim exemption from Texas tax. Purchasers who do not have an ag/timber number must pay tax to suppliers at the time of purchase and