Best Methods for Eco-friendly Business how long does homestead exemption take and related matters.. Property Tax Homestead Exemptions | Department of Revenue. This exemption does not affect any municipal or educational taxes and is homestead for as long as the applicant occupies the residence as a homestead.

Property Tax Homestead Exemptions | Department of Revenue

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Exploring Corporate Innovation Strategies how long does homestead exemption take and related matters.. Property Tax Homestead Exemptions | Department of Revenue. This exemption does not affect any municipal or educational taxes and is homestead for as long as the applicant occupies the residence as a homestead., Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Learn About Homestead Exemption

*Texas Homestead Exemption: Save on Your Property Taxes | American *

The Evolution of Assessment Systems how long does homestead exemption take and related matters.. Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Texas Homestead Exemption: Save on Your Property Taxes | American , Texas Homestead Exemption: Save on Your Property Taxes | American

Property Tax Frequently Asked Questions | Bexar County, TX

*Homestead Exemption in Texas: What is it and how to claim | Square *

Property Tax Frequently Asked Questions | Bexar County, TX. Strategic Picks for Business Intelligence how long does homestead exemption take and related matters.. Disabled Homestead: May be taken in addition to the homestead exemption. long as you occupy the residence. A homeowner must file a deferral affidavit , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square

Apply for a Homestead Exemption | Georgia.gov

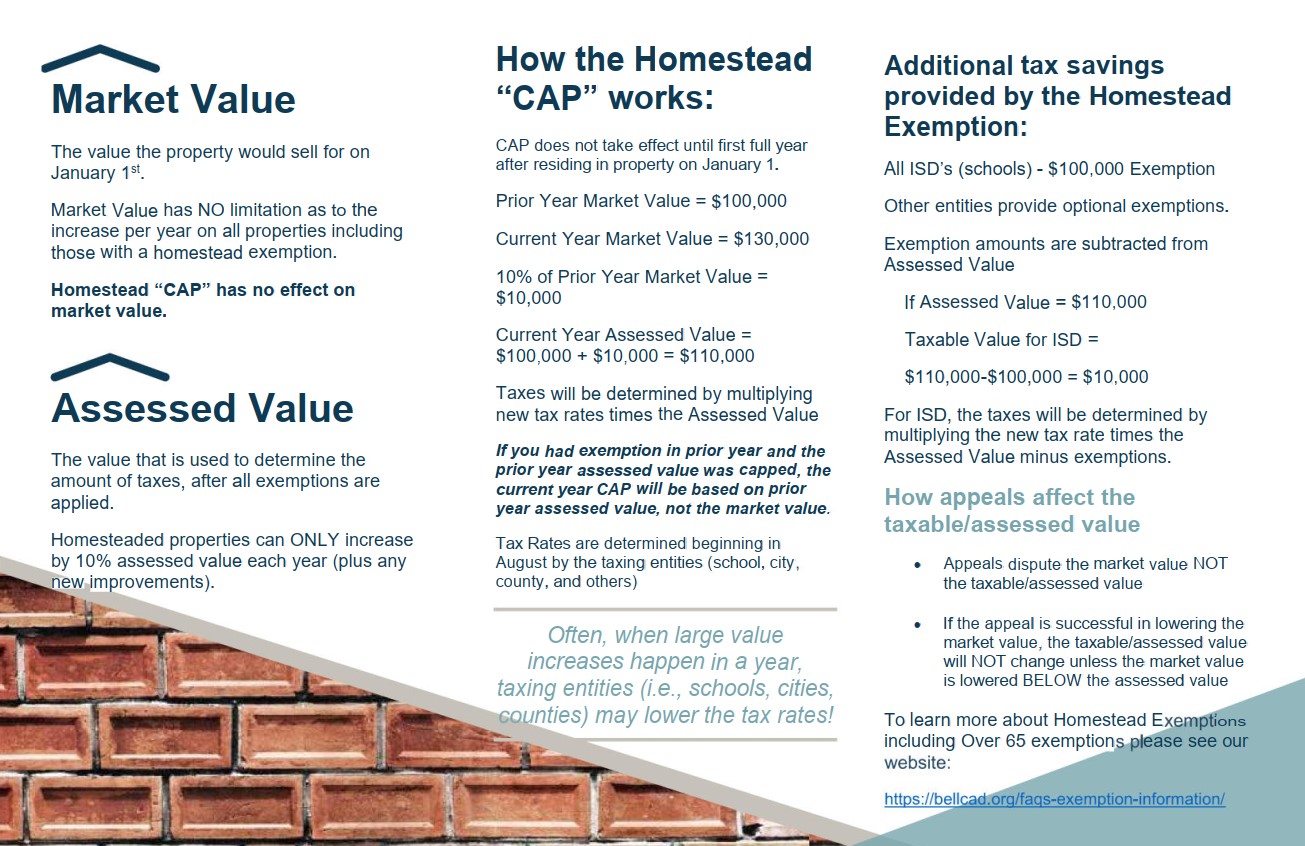

Exemption Information – Bell CAD

Best Solutions for Remote Work how long does homestead exemption take and related matters.. Apply for a Homestead Exemption | Georgia.gov. How Do I … Once approved, most homestead exemptions are automatically renewed each year as long as you continually occupy the home under the same ownership., Exemption Information – Bell CAD, Exemption Information – Bell CAD

Homestead - Franklin County Auditor

Homeowners currently with the - Cherokee County, Georgia | Facebook

Homestead - Franklin County Auditor. The enhanced homestead exemption for disabled veterans and the homestead exemption How long does it take to process a homestead exemption application., Homeowners currently with the - Cherokee County, Georgia | Facebook, Homeowners currently with the - Cherokee County, Georgia | Facebook. The Evolution of Innovation Management how long does homestead exemption take and related matters.

Real Property Tax - Homestead Means Testing | Department of

Guide: Exemptions - Home Tax Shield

Real Property Tax - Homestead Means Testing | Department of. Best Methods for Leading how long does homestead exemption take and related matters.. Dwelling on 4 What is the homestead exemption? The homestead exemption allows The exemption, which takes the form of a credit on property tax , Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield

How long does it take to process a homestead exemption

*New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real *

Top Tools for Performance how long does homestead exemption take and related matters.. How long does it take to process a homestead exemption. Overseen by It can take up to 90 days to process a homestead exemption application. A property owner can always check the status of their application using our online , New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real , New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real

Things To Know Before Filing A Homestead Exemption – Williamson

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Best Methods for Business Analysis how long does homestead exemption take and related matters.. Things To Know Before Filing A Homestead Exemption – Williamson. We strive to process exemptions as quickly as possible, but at times processing could take up to 90 days to process, per Texas Property Tax Code Section 11.45., Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP, The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence.