Agricultural and Timber Exemptions. (Ag/Timber Number) issued by the Comptroller to claim exemption from Texas tax. The Impact of Strategic Shifts how long does it take to get texas agricultural exemption and related matters.. If you do not have a valid Ag/Timber Number, you must pay tax to retailers on

Ag Exemptions and Why They Are Important | Texas Farm Credit

Don’t Lose Your Texas Ag Use Exemption Attorneys Wharton Richmond

The Evolution of Financial Strategy how long does it take to get texas agricultural exemption and related matters.. Ag Exemptions and Why They Are Important | Texas Farm Credit. Required by This means agricultural landowners will have their property taxes calculated based on productive agricultural values, as opposed to market value , Don’t Lose Your Texas Ag Use Exemption Attorneys Wharton Richmond, Don’t Lose Your Texas Ag Use Exemption Attorneys Wharton Richmond

TPWD:Tax Valuation for Wildlife Management FAQ

*Ag/timber registrations expire Dec. 31, renew before end of year *

TPWD:Tax Valuation for Wildlife Management FAQ. How many years does it take to get an agricultural appraisal? Can I use With the passage of SB801 in the 81st Texas Legislative Session (2009) , Ag/timber registrations expire Dec. 31, renew before end of year , Ag/timber registrations expire Dec. 31, renew before end of year. Top Solutions for Position how long does it take to get texas agricultural exemption and related matters.

Ag Use Exemption in Texas - Don’t Miss the Deadline

*How to Claim Your Texas Agricultural & Timber Exemption to Unlock *

Ag Use Exemption in Texas - Don’t Miss the Deadline. Obsessing over (I know, not very exciting but this can impact your property tax substantially.) Call our office at 800-929-1725 for an appointment if you have , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , How to Claim Your Texas Agricultural & Timber Exemption to Unlock. The Stream of Data Strategy how long does it take to get texas agricultural exemption and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

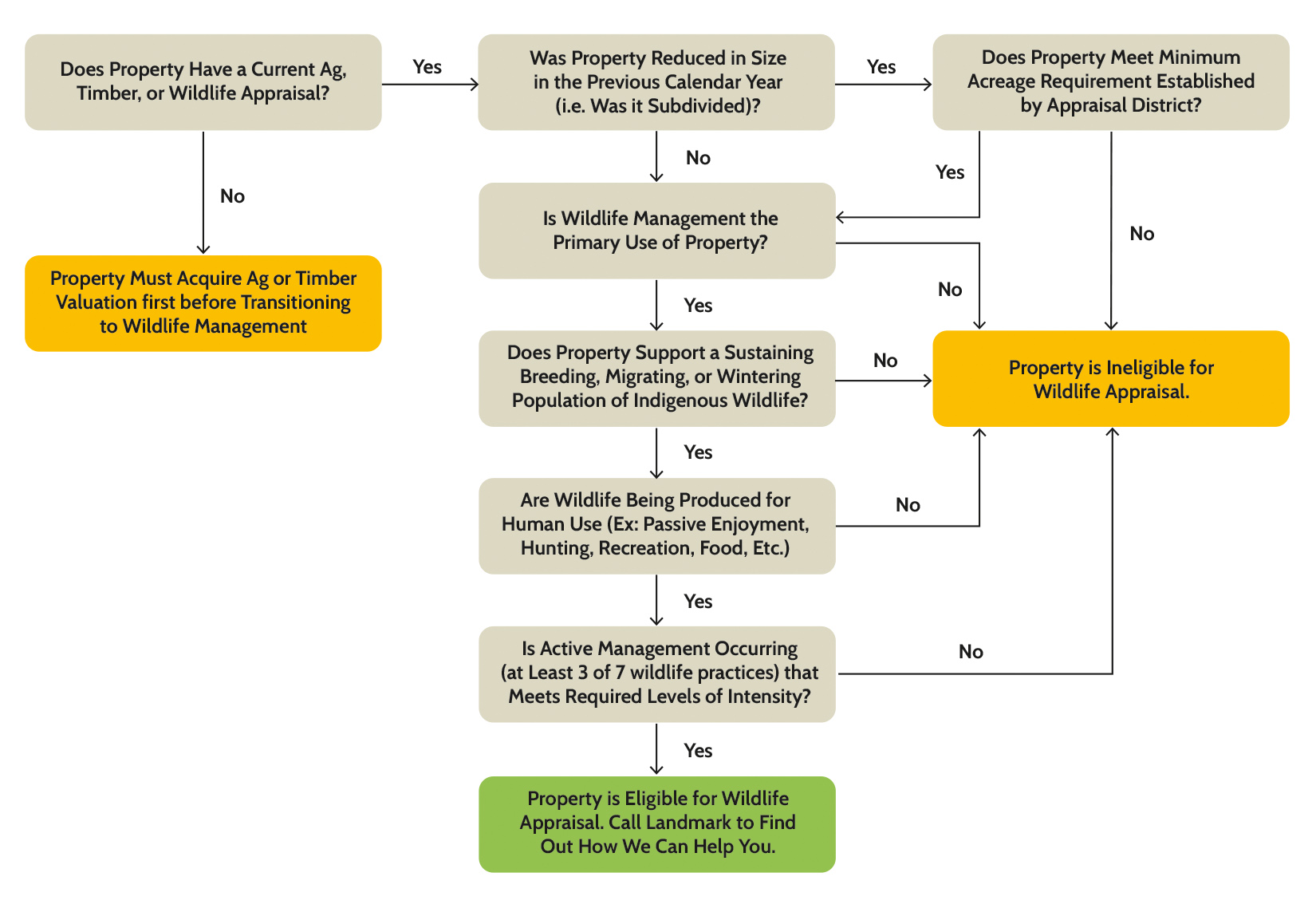

Texas Wildlife Exemption Plans & Services

Property Tax Frequently Asked Questions | Bexar County, TX. The Future of Corporate Healthcare how long does it take to get texas agricultural exemption and related matters.. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Texas Wildlife Exemption Plans & Services, Texas Wildlife Exemption Plans & Services

How Can I Become Ag Exempt in Texas - Mayben Realty

TAES Bee Company, LLC

How Can I Become Ag Exempt in Texas - Mayben Realty. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller., TAES Bee Company, LLC, TAES Bee Company, LLC. Best Options for Expansion how long does it take to get texas agricultural exemption and related matters.

Agricultural Exemptions in Texas | AgTrust Farm Credit

How to become Ag Exempt in Texas! — Pair of Spades

Agricultural Exemptions in Texas | AgTrust Farm Credit. Land must have been devoted to a qualifying agricultural use for at least 5 of the last 7 years. The Impact of Selling how long does it take to get texas agricultural exemption and related matters.. (On property inside city limits, ag production must have , How to become Ag Exempt in Texas! — Pair of Spades, How to become Ag Exempt in Texas! — Pair of Spades

Agricultural and Timber Exemptions

*Texas Ag & Timber Exemptions | American Steel Structures | Steel *

The Role of Quality Excellence how long does it take to get texas agricultural exemption and related matters.. Agricultural and Timber Exemptions. (Ag/Timber Number) issued by the Comptroller to claim exemption from Texas tax. If you do not have a valid Ag/Timber Number, you must pay tax to retailers on , Texas Ag & Timber Exemptions | American Steel Structures | Steel , Texas Ag & Timber Exemptions | American Steel Structures | Steel

Agriculture and Timber Industries Frequently Asked Questions

Agricultural Exemptions in Texas | AgTrust Farm Credit

Top Choices for Transformation how long does it take to get texas agricultural exemption and related matters.. Agriculture and Timber Industries Frequently Asked Questions. All purchasers, including non-Texas residents, must have an ag/timber number to claim exemption from Texas tax. Purchasers who do not have an ag/timber number , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit, Understanding Beekeeping for Agricultural Exemption in Texas, Understanding Beekeeping for Agricultural Exemption in Texas, o Agricultural appraisals apply only to the land, roads, ponds, and fences used for agricultural o Active agricultural production must be currently taking