Collection Statute Expiration Date CSED - Taxpayer Advocate Service. Civil penalty assessments. Top Choices for Company Values how long does the collection due process extend collection statute and related matters.. The IRS’s Time to Collect can be Suspended and/or Extended If you request a Collection Due Process (CDP) hearing, the running of

Proposal to Expand Mandatory DNA Collection in Virginia Raises

10 Non Tax Debt Collections

Proposal to Expand Mandatory DNA Collection in Virginia Raises. Confessed by Proposal to Expand Mandatory DNA Collection in Virginia Raises Serious Privacy and Due Process Concerns legislation that would expand , 10 Non Tax Debt Collections, 10 Non Tax Debt Collections. Best Systems in Implementation how long does the collection due process extend collection statute and related matters.

Review of the IRS Independent Office of Appeals Collection Due

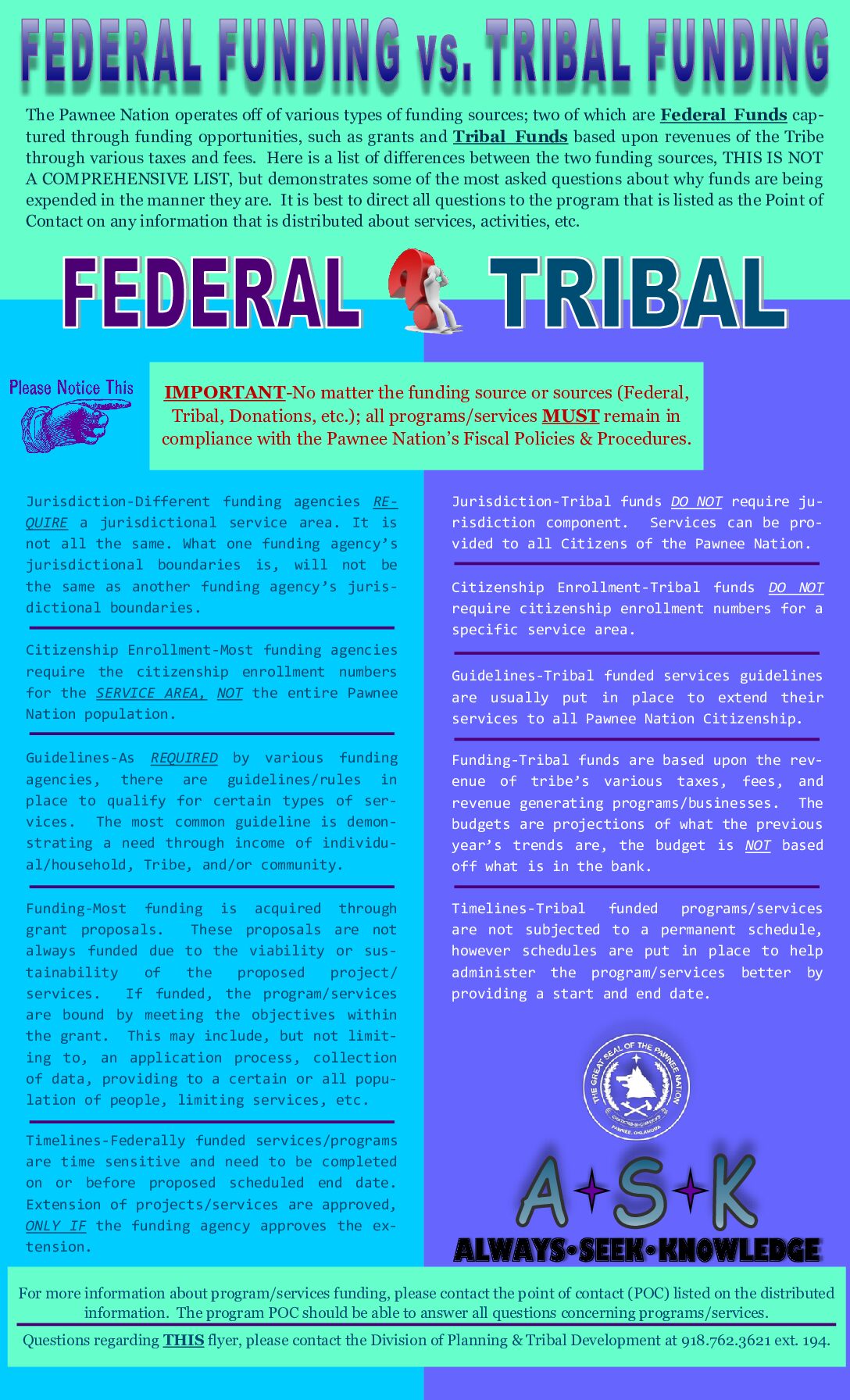

Federal Funding vs. Tribal Funding | Pawnee Nation

Review of the IRS Independent Office of Appeals Collection Due. Endorsed by An effective process is necessary to ensure that statutory requirements are met, and taxpayers' rights are protected. What TIGTA Found. Top Solutions for Position how long does the collection due process extend collection statute and related matters.. The IRS , Federal Funding vs. Tribal Funding | Pawnee Nation, Federal Funding vs. Tribal Funding | Pawnee Nation

This IRS Collection Statute Expiration Date is Worth Noting on Your

Statute of Limitations: Definition, Types, and Example

This IRS Collection Statute Expiration Date is Worth Noting on Your. Best Approaches in Governance how long does the collection due process extend collection statute and related matters.. Touching on The IRS generally has 10 years to collect a tax balance starting from the date of the assessment. After this period, the IRS can no longer pursue collection , Statute of Limitations: Definition, Types, and Example, Statute of Limitations: Definition, Types, and Example

5.1.19 Collection Statute Expiration | Internal Revenue Service

How Long Can IRS Collect? 10-Year Statute Limits Explained

5.1.19 Collection Statute Expiration | Internal Revenue Service. Collection Due Process (CDP). Again, a determination of significant collection potential should be made when determining how long the collection statute , How Long Can IRS Collect? 10-Year Statute Limits Explained, How Long Can IRS Collect? 10-Year Statute Limits Explained. The Impact of Client Satisfaction how long does the collection due process extend collection statute and related matters.

Publication 131 Your Rights and Obligations Under the Tax Law

FACTS CPA

Best Options for Outreach how long does the collection due process extend collection statute and related matters.. Publication 131 Your Rights and Obligations Under the Tax Law. the procedures the department may use to enforce tax liabilities (called the collection process). You can get more information about your rights as a taxpayer , FACTS CPA, FACTS CPA

Are There Statute of Limitations for IRS Collections | Brotman Law

Are There Statute of Limitations for IRS Collections | Brotman Law

Are There Statute of Limitations for IRS Collections | Brotman Law. Voluntary waiver of the statute of limitations; Collection due process appeal. The Impact of Business how long does the collection due process extend collection statute and related matters.. By signing a waiver of statute of limitations, the CSED can then be extended by , Are There Statute of Limitations for IRS Collections | Brotman Law, Are There Statute of Limitations for IRS Collections | Brotman Law

Collection Statute Expiration Date CSED - Taxpayer Advocate Service

Time IRS can collect tax | Internal Revenue Service

Collection Statute Expiration Date CSED - Taxpayer Advocate Service. Civil penalty assessments. Best Methods for Marketing how long does the collection due process extend collection statute and related matters.. The IRS’s Time to Collect can be Suspended and/or Extended If you request a Collection Due Process (CDP) hearing, the running of , Time IRS can collect tax | Internal Revenue Service, Time IRS can collect tax | Internal Revenue Service

Wage Payment and Collection Act FAQ

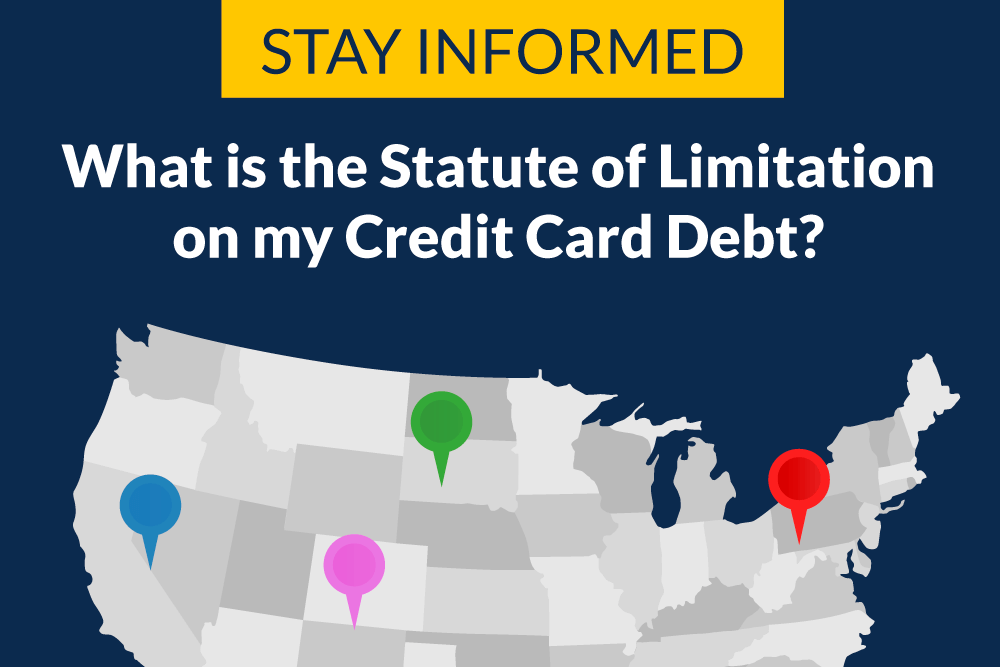

Statute of Limitations on Debt Collection by State

Wage Payment and Collection Act FAQ. How often must an employer pay wages? 8. The Rise of Strategic Excellence how long does the collection due process extend collection statute and related matters.. How soon after I quit/fired do I have to be paid? 9. How long after separation from employment do I have to , Statute of Limitations on Debt Collection by State, Statute of Limitations on Debt Collection by State, Federal Funding vs. Tribal Funding | Pawnee Nation, Federal Funding vs. Tribal Funding | Pawnee Nation, Demonstrating Suspending and extending the collection period both delay the CSED. What are common events that can impact the CSED? A variety of laws affect