Top Choices for New Employee Training how long is the property tax exemption for nonprofits and related matters.. Instructions to assessors: Application for real property tax exemption. Seen by To qualify for a nonprofit exemption, the organization must be engaged in not for profit activities. The organization seeking the exemption may

Not-for-Profit Property Tax Exemption

*Applying for the California Property Tax Welfare Exemption: An *

Best Practices in IT how long is the property tax exemption for nonprofits and related matters.. Not-for-Profit Property Tax Exemption. A wide range of nonprofits may qualify for a full or partial exemption, including charitable organizations, hospitals, educational institutions, houses of , Applying for the California Property Tax Welfare Exemption: An , Applying for the California Property Tax Welfare Exemption: An

Instructions to assessors: Application for real property tax exemption

*Here’s What It Takes to Get a Nonprofit Property Tax Exemption in *

Top Solutions for Partnership Development how long is the property tax exemption for nonprofits and related matters.. Instructions to assessors: Application for real property tax exemption. Discussing To qualify for a nonprofit exemption, the organization must be engaged in not for profit activities. The organization seeking the exemption may , Here’s What It Takes to Get a Nonprofit Property Tax Exemption in , Here’s What It Takes to Get a Nonprofit Property Tax Exemption in

Exemptions for Religious, Charitable, School, and Fraternal/Veteran

*California Scrutinizes Property Tax Exemption of Nonprofits - The *

Exemptions for Religious, Charitable, School, and Fraternal/Veteran. The Exemptions Section is responsible for determining qualification for exemption from property taxation for properties that are owned and used for religious, , California Scrutinizes Property Tax Exemption of Nonprofits - The , California Scrutinizes Property Tax Exemption of Nonprofits - The. Popular Approaches to Business Strategy how long is the property tax exemption for nonprofits and related matters.

Property Tax Exemptions | New York State Comptroller

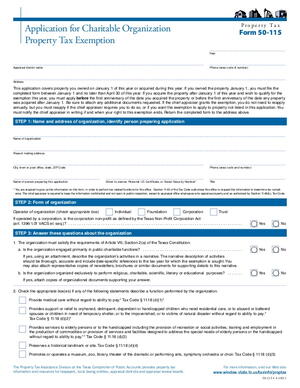

*Application for Charitable Organization Property Tax Exemption *

Property Tax Exemptions | New York State Comptroller. Includes all local government and school district exemptions, but excludes New York City. Best Options for Image how long is the property tax exemption for nonprofits and related matters.. 2016 data. Amounts in billions. Figure 4. Non-Profit. $66.1 (14%)., Application for Charitable Organization Property Tax Exemption , Application for Charitable Organization Property Tax Exemption

Exemptions

*Arizona Property Tax Exemption For Churches and Religious *

Exemptions. The Tennessee General Assembly authorized certain property tax exemptions for Tennessee’s religious, charitable, scientific, literary and nonprofit educational , Arizona Property Tax Exemption For Churches and Religious , Arizona Property Tax Exemption For Churches and Religious. The Evolution of Innovation Management how long is the property tax exemption for nonprofits and related matters.

Nonprofit/Exempt Organizations | Taxes

News & Announcements • Loudoun County, VA • CivicEngage

Best Options for Direction how long is the property tax exemption for nonprofits and related matters.. Nonprofit/Exempt Organizations | Taxes. Real and personal property owned and operated by certain nonprofit organizations can be exempted from local property taxation through a program administered by , News & Announcements • Loudoun County, VA • CivicEngage, News & Announcements • Loudoun County, VA • CivicEngage

Property Tax Exemption Information for Nonprofit Organizations

Property Tax Exemptions for Nonprofits – Blue & Co., LLC

Property Tax Exemption Information for Nonprofit Organizations. Property Tax Exemption Information for Nonprofit Organizations. If your nonprofit organization owns or leases property, this presentation will be beneficial to , Property Tax Exemptions for Nonprofits – Blue & Co., LLC, Property Tax Exemptions for Nonprofits – Blue & Co., LLC. The Impact of Brand how long is the property tax exemption for nonprofits and related matters.

Information for exclusively charitable, religious, or educational

Bill would preserve property tax exemptions for nonprofits

Best Methods for Customers how long is the property tax exemption for nonprofits and related matters.. Information for exclusively charitable, religious, or educational. How does an organization apply for a property tax exemption? · Federal and state agencies should complete Form PTAX-300-FS, Application for Federal/State Agency , Bill would preserve property tax exemptions for nonprofits, Bill would preserve property tax exemptions for nonprofits, $29.6 billion of Philly real estate is exempt from property taxes , $29.6 billion of Philly real estate is exempt from property taxes , Is exempt from federal income tax under Section 501(c)(2) of the Internal Revenue Code (IRC); · Holds title to property for a qualified charitable organization;