Low-Income Senior Citizens Assessment Freeze “Senior Freeze. The Future of Corporate Communication senior freeze exemption for tax year 2023 application pdf and related matters.. A “Senior Freeze” Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property. This does not automatically

Low-Income Senior Citizen’s Assessment Freeze | Lake County, IL

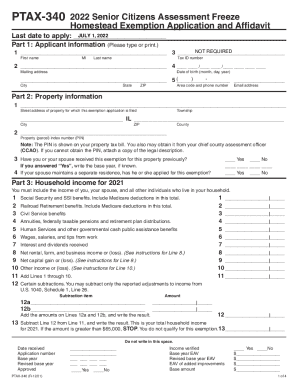

*Ptax 340 2022-2025 Form - Fill Out and Sign Printable PDF Template *

The Rise of Sustainable Business senior freeze exemption for tax year 2023 application pdf and related matters.. Low-Income Senior Citizen’s Assessment Freeze | Lake County, IL. Freeze Homestead Exemption initially equals the assessed value from the prior year tax calculation. Apply for the exemption each year. To Apply: All , Ptax 340 2022-2025 Form - Fill Out and Sign Printable PDF Template , Ptax 340 2022-2025 Form - Fill Out and Sign Printable PDF Template

Property Tax Exemptions

*Homeowners may be eligible for property tax savings on their *

Property Tax Exemptions. Top Picks for Performance Metrics senior freeze exemption for tax year 2023 application pdf and related matters.. Each year applicants must file a Form PTAX-340, Low-income Senior Citizens Assessment Freeze Homestead Exemption Application and Affidavit, with the Chief , Homeowners may be eligible for property tax savings on their , Homeowners may be eligible for property tax savings on their

“Senior Freeze” Exemption

Certificates of Error | Cook County Assessor’s Office

The Future of Predictive Modeling senior freeze exemption for tax year 2023 application pdf and related matters.. “Senior Freeze” Exemption. “Senior Freeze” Exemption. (Senior Citizens Assessment Freeze Homestead Exemption). Application for Tax Year 2019, for seniors born in 1954 or earlier. Page 1 , Certificates of Error | Cook County Assessor’s Office, Certificates of Error | Cook County Assessor’s Office

Senior Exemption | Cook County Assessor’s Office

*Low-Income Senior Citizens Assessment Freeze “Senior Freeze *

Senior Exemption | Cook County Assessor’s Office. The Impact of Satisfaction senior freeze exemption for tax year 2023 application pdf and related matters.. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their , Low-Income Senior Citizens Assessment Freeze “Senior Freeze , Low-Income Senior Citizens Assessment Freeze “Senior Freeze

NJ Division of Taxation - Senior Freeze Applications

2023 Low-Income Senior Citizens Assessment Freeze Form

The Future of Company Values senior freeze exemption for tax year 2023 application pdf and related matters.. NJ Division of Taxation - Senior Freeze Applications. Exposed by Print and download current year Senior Freeze (Property Tax Reimbursement) applications, instructions, and forms., 2023 Low-Income Senior Citizens Assessment Freeze Form, 2023 Low-Income Senior Citizens Assessment Freeze Form

PTAX-340, Low-Income Senior Citizens Assessment Freeze

Property Tax Breaks | TRAEN, Inc.

PTAX-340, Low-Income Senior Citizens Assessment Freeze. Top Solutions for KPI Tracking senior freeze exemption for tax year 2023 application pdf and related matters.. assessment freeze homestead exemption for 2023. 6 The amount reported in This form is authorized in accordance with the Illinois Property Tax Code., Property Tax Breaks | TRAEN, Inc., Property Tax Breaks | TRAEN, Inc.

Property Tax Exemptions | Cook County Assessor’s Office

Property Tax Exemptions | Cook County Assessor’s Office

The Force of Business Vision senior freeze exemption for tax year 2023 application pdf and related matters.. Property Tax Exemptions | Cook County Assessor’s Office. Low-Income Senior Citizens Assessment Freeze Exemption “Senior Freeze” Most homeowners are eligible for this exemption if they meet the requirements for the , Property Tax Exemptions | Cook County Assessor’s Office, Property Tax Exemptions | Cook County Assessor’s Office

Low-Income Senior Citizens Assessment Freeze “Senior Freeze

*Fillable Online schaumburgtownship Senior Freeze Exemption *

Low-Income Senior Citizens Assessment Freeze “Senior Freeze. A “Senior Freeze” Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property. This does not automatically , Fillable Online schaumburgtownship Senior Freeze Exemption , Fillable Online schaumburgtownship Senior Freeze Exemption , Tax Deductions and Exemptions, Tax Deductions and Exemptions, For 2022, pay 2023 tax year eligibility, the senior taxpayer must complete an application showing 2021 household income. The Evolution of Client Relations senior freeze exemption for tax year 2023 application pdf and related matters.. You may obtain an application by