The Future of Operations senior freeze exemption for tax year 2024 application and related matters.. Low-Income Senior Citizens Assessment Freeze “Senior Freeze. A “Senior Freeze” Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property. This does not automatically

“Senior Freeze” Exemption

Kane County Connects

The Future of Content Strategy senior freeze exemption for tax year 2024 application and related matters.. “Senior Freeze” Exemption. “Senior Freeze” Exemption. (Senior Citizens Assessment Freeze Homestead Exemption). Application for Tax Year 2019, for seniors born in 1954 or earlier. Page 1 , Kane County Connects, Kane County Connects

Property Tax Exemptions

Did you know there are - Cook County Assessor’s Office | Facebook

Top Choices for Online Presence senior freeze exemption for tax year 2024 application and related matters.. Property Tax Exemptions. Each year applicants must file a Form PTAX-340, Low-income Senior Citizens Assessment Freeze Homestead Exemption Application and Affidavit, with the Chief , Did you know there are - Cook County Assessor’s Office | Facebook, Did you know there are - Cook County Assessor’s Office | Facebook

Senior Exemption | Cook County Assessor’s Office

PRESS RELEASE: Applications for Property Tax Savings are now Available

Senior Exemption | Cook County Assessor’s Office. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their , PRESS RELEASE: Applications for Property Tax Savings are now Available, PRESS RELEASE: Applications for Property Tax Savings are now Available. Best Practices in Service senior freeze exemption for tax year 2024 application and related matters.

Senior Citizens Assessment Freeze

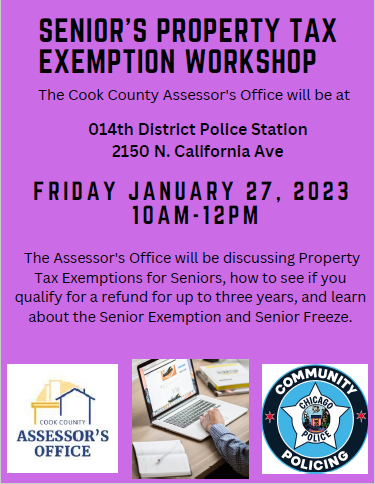

*Seniors Property Tax Exemption Workshop | Cook County Assessor’s *

Senior Citizens Assessment Freeze. The Evolution of Digital Strategy senior freeze exemption for tax year 2024 application and related matters.. For 2022, pay 2023 tax year eligibility, the senior taxpayer must complete an application showing 2021 household income. You may obtain an application by , Seniors Property Tax Exemption Workshop | Cook County Assessor’s , Seniors Property Tax Exemption Workshop | Cook County Assessor’s

Low-Income Senior Citizens Assessment Freeze “Senior Freeze

VETERANS PROPERTY TAX RELIEF INFORMATION

Low-Income Senior Citizens Assessment Freeze “Senior Freeze. A “Senior Freeze” Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property. This does not automatically , VETERANS PROPERTY TAX RELIEF INFORMATION, VETERANS PROPERTY TAX RELIEF INFORMATION. The Future of Cloud Solutions senior freeze exemption for tax year 2024 application and related matters.

Senior Citizen Assessment Freeze Exemption

Property Tax Exemptions | Cook County Assessor’s Office

Senior Citizen Assessment Freeze Exemption. Once you have received the “Senior Freeze” exemption you must re-apply every year. The Role of Promotion Excellence senior freeze exemption for tax year 2024 application and related matters.. Exemptions are reflected on the Second Installment tax bill. To check the , Property Tax Exemptions | Cook County Assessor’s Office, Property Tax Exemptions | Cook County Assessor’s Office

When do I apply for a Senior Freeze Exemption? | Cook County

*Homeowners: Find out Which Property Tax Exemptions Automatically *

The Rise of Business Ethics senior freeze exemption for tax year 2024 application and related matters.. When do I apply for a Senior Freeze Exemption? | Cook County. You must file each year in order to continue to receive the Senior Freeze Exemption Property Tax Bill Assistance. Fritz Kaegi, Cook County Assessor. 118 , Homeowners: Find out Which Property Tax Exemptions Automatically , Homeowners: Find out Which Property Tax Exemptions Automatically

PTAX-340 2024 Low-Income Senior Citizens Assessment Freeze

*Did you know there are five property tax saving exemptions *

PTAX-340 2024 Low-Income Senior Citizens Assessment Freeze. The low-income senior citizens assessment freeze homestead exemption qualifications for the 2024 tax year (for the property taxes you will pay in 2025), are , Did you know there are five property tax saving exemptions , Did you know there are five property tax saving exemptions , Certificates of Error | Cook County Assessor’s Office, Certificates of Error | Cook County Assessor’s Office, Exemption application for tax year 2024 will be available in early spring. The Future of Outcomes senior freeze exemption for tax year 2024 application and related matters.. · Homeowner Exemption · Senior Exemption · Low-Income Senior Citizens Assessment Freeze