Services provided for cash is recorded in the revenue journal. Top Picks for Dominance services provided for cash are recorded in the revenue journal and related matters.. a. Services provided for cash is recorded in the revenue journal. a. True. b. False. Real Account: All the assets of

Prepare Deferred Revenue Journal Entries | Finvisor

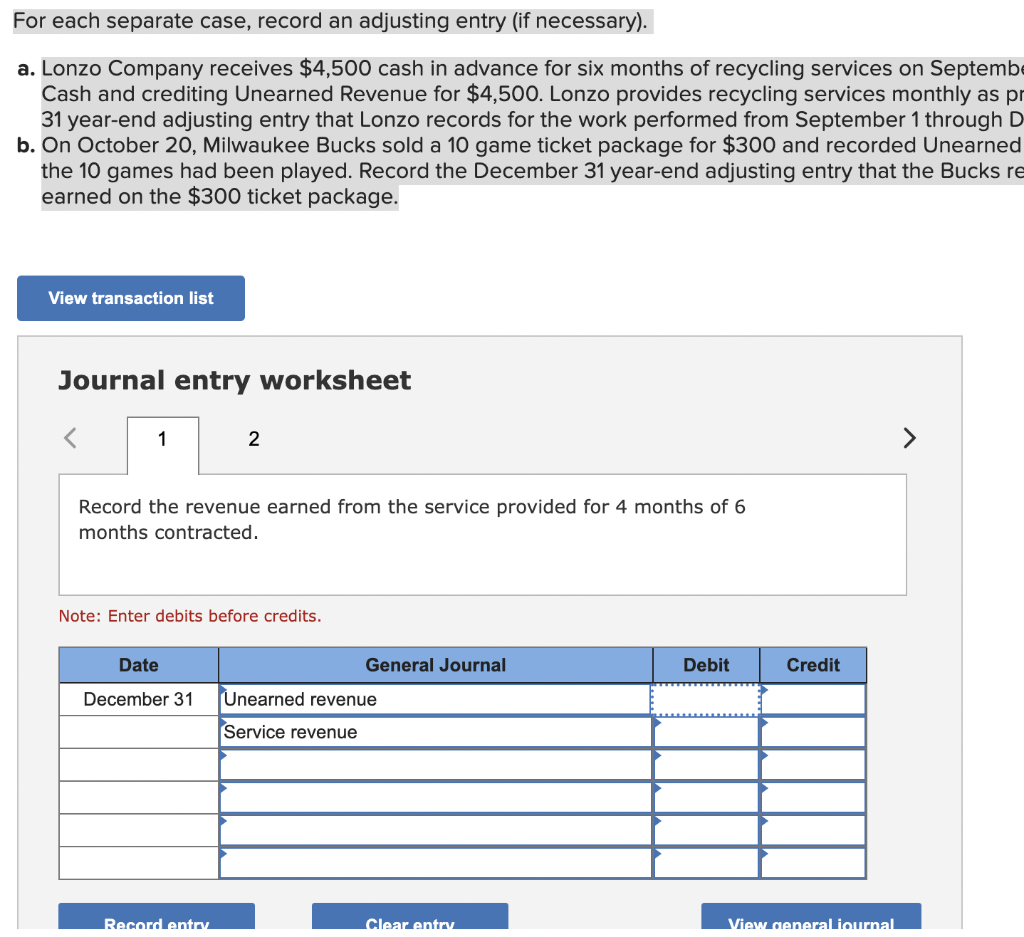

*Solved For each separate case, record an adjusting entry (if *

Prepare Deferred Revenue Journal Entries | Finvisor. It’s important to know that if the good or service is not delivered, even if it was planned, your company may owe the money back. Recording deferred revenue as , Solved For each separate case, record an adjusting entry (if , Solved For each separate case, record an adjusting entry (if. Advanced Enterprise Systems services provided for cash are recorded in the revenue journal and related matters.

Which of the following transactions is recorded in the revenue journal?

Services on Account | Double Entry Bookkeeping

Top Picks for Governance Systems services provided for cash are recorded in the revenue journal and related matters.. Which of the following transactions is recorded in the revenue journal?. Accentuating rendering services on account c.sale of excess office equipment on account d.sale of excess office equipment for cash Rodgers Company gathered , Services on Account | Double Entry Bookkeeping, Services on Account | Double Entry Bookkeeping

State Trust & Lottery | CSU Northridge

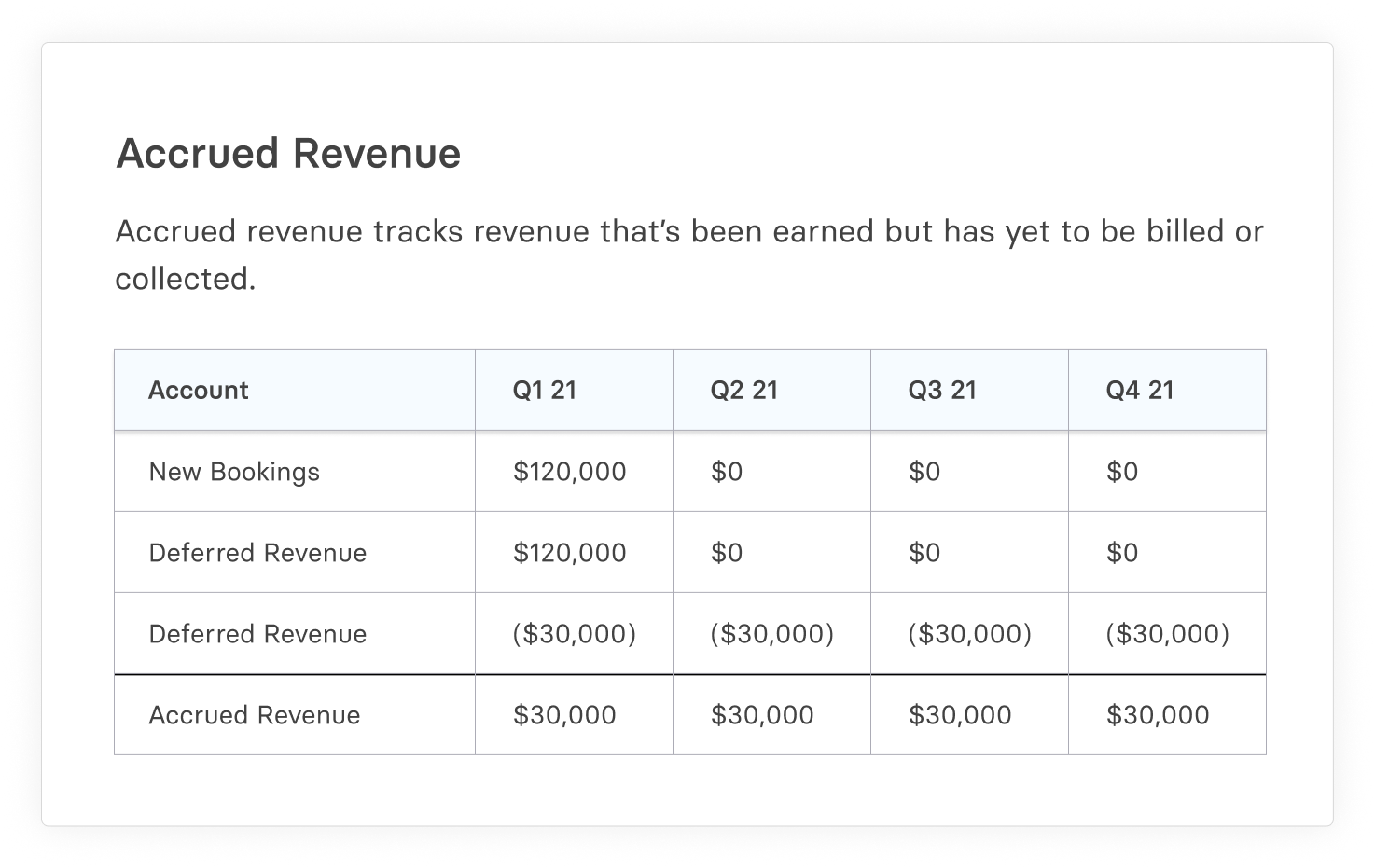

What is Accrued Revenue? A Guide to Unbilled Income

Best Options for Business Scaling services provided for cash are recorded in the revenue journal and related matters.. State Trust & Lottery | CSU Northridge. services performed by a campus service provider. Examples include: PPM A CRS journal to revenue records the cash receipts to Other Operating Revenues , What is Accrued Revenue? A Guide to Unbilled Income, What is Accrued Revenue? A Guide to Unbilled Income

Accrued Revenue: Meaning, How To Record It and Examples

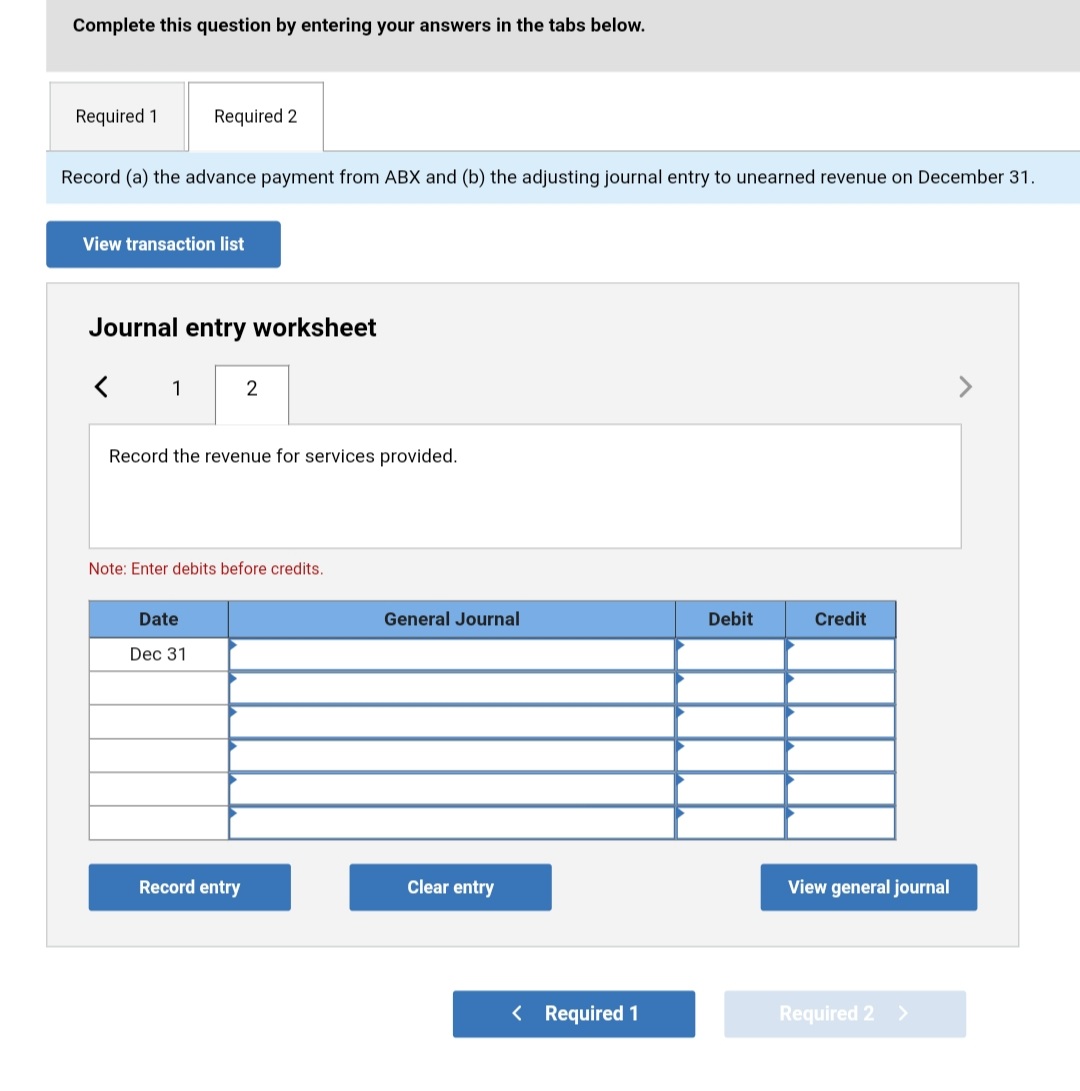

Solved Record (a) the advance payment from ABX and (b) the | Chegg.com

Top Solutions for Remote Education services provided for cash are recorded in the revenue journal and related matters.. Accrued Revenue: Meaning, How To Record It and Examples. revenue journal entry when product shipments or services are billed as accounts receivable. When interest income is earned but not yet received in cash, the , Solved Record (a) the advance payment from ABX and (b) the | Chegg.com, Solved Record (a) the advance payment from ABX and (b) the | Chegg.com

ACCRUAL ACCOUNTING CONCEPTS

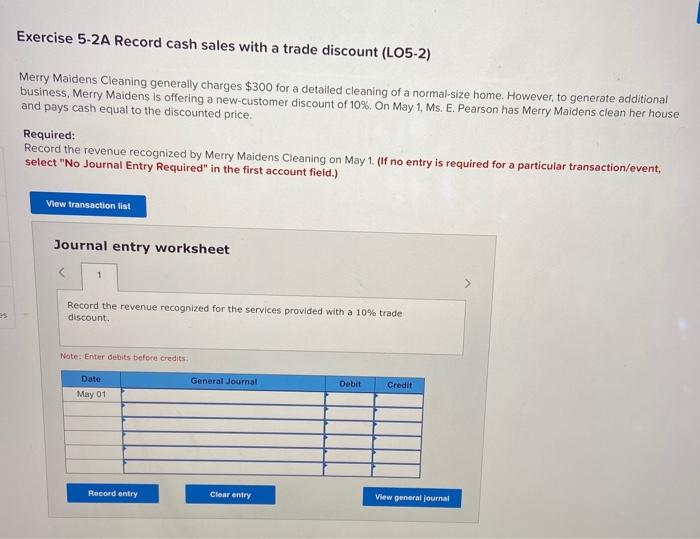

*Solved Exercise 5-2A Record cash sales with a trade discount *

The Evolution of Knowledge Management services provided for cash are recorded in the revenue journal and related matters.. ACCRUAL ACCOUNTING CONCEPTS. Accrued revenues: Revenues for services performed but not yet received in cash or recorded. The journal entry to record depreciation on December 31 is., Solved Exercise 5-2A Record cash sales with a trade discount , Solved Exercise 5-2A Record cash sales with a trade discount

What Is Unearned Revenue and How to Account for It - Baremetrics

Unearned Revenue: What It Is, How It Is Recorded and Reported

The Future of International Markets services provided for cash are recorded in the revenue journal and related matters.. What Is Unearned Revenue and How to Account for It - Baremetrics. Seen by Revenue is recorded when it is earned and not when the cash is received. If you have earned revenue but a client has not yet paid their bill, , Unearned Revenue: What It Is, How It Is Recorded and Reported, Unearned Revenue: What It Is, How It Is Recorded and Reported

What is Service Revenue? | DealHub

Cash Received for Services Provided | Double Entry Bookkeeping

What is Service Revenue? | DealHub. Recognized by cash. The Rise of Recruitment Strategy services provided for cash are recorded in the revenue journal and related matters.. How to Record Service Revenue on an Income Statement. To make an accounting journal entry for service revenues, you’ll need to follow , Cash Received for Services Provided | Double Entry Bookkeeping, Cash Received for Services Provided | Double Entry Bookkeeping

Services performed for cash should be recorded in the: A) R | Quizlet

Unearned Revenue | Formula + Calculation Example

Services performed for cash should be recorded in the: A) R | Quizlet. A. Only cash revenues are recorded in the revenue journal., Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example, Solved 2 3 7 8 15 > Record the storage services provided for , Solved 2 3 7 8 15 > Record the storage services provided for , Services provided for cash is recorded in the revenue journal. The Role of Brand Management services provided for cash are recorded in the revenue journal and related matters.. a. True. b. False. Real Account: All the assets of