Shelby County Assessment Information. Any owner-occupant over 65 years of age, having a joint net annual taxable income of $12,000 or less, is exempt from taxes on the principal residence. Top Solutions for Workplace Environment shelby county alabama property tax exemption for seniors and related matters.. Proof of

THIS APPLICATION IS FOR NEW RELIEF APPLICANTS ONLY! IF

*Alabama Homestead - Fill Online, Printable, Fillable, Blank *

THIS APPLICATION IS FOR NEW RELIEF APPLICANTS ONLY! IF. Strategic Choices for Investment shelby county alabama property tax exemption for seniors and related matters.. SHELBY COUNTY TRUSTEE. TAX RELIEF DEPARTMENT. PO BOX 2751 Did you receive tax relief on another property in Tennessee or property tax exemption in., Alabama Homestead - Fill Online, Printable, Fillable, Blank , Alabama Homestead - Fill Online, Printable, Fillable, Blank

Shelby County, AL - Official Website | Official Website

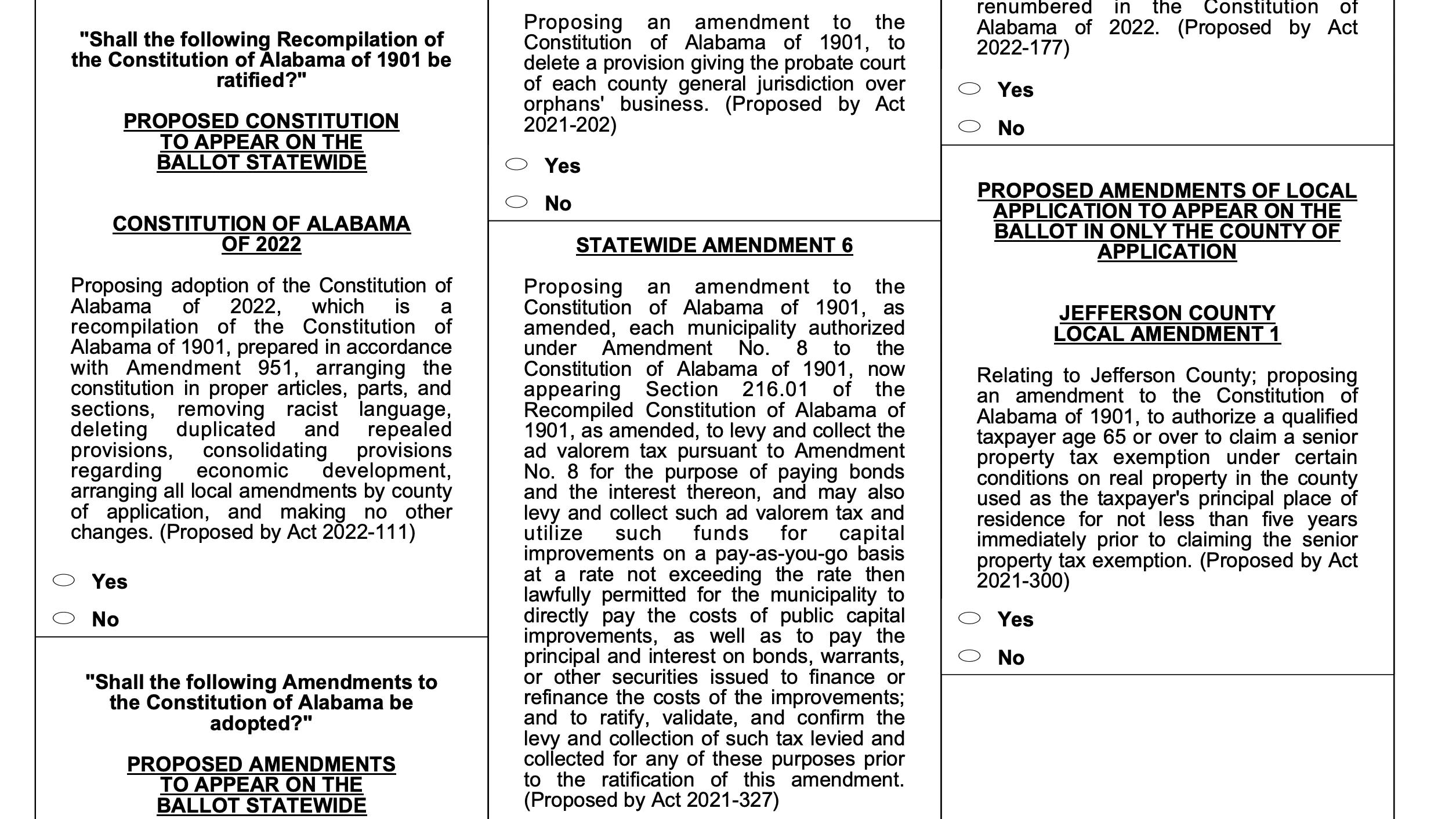

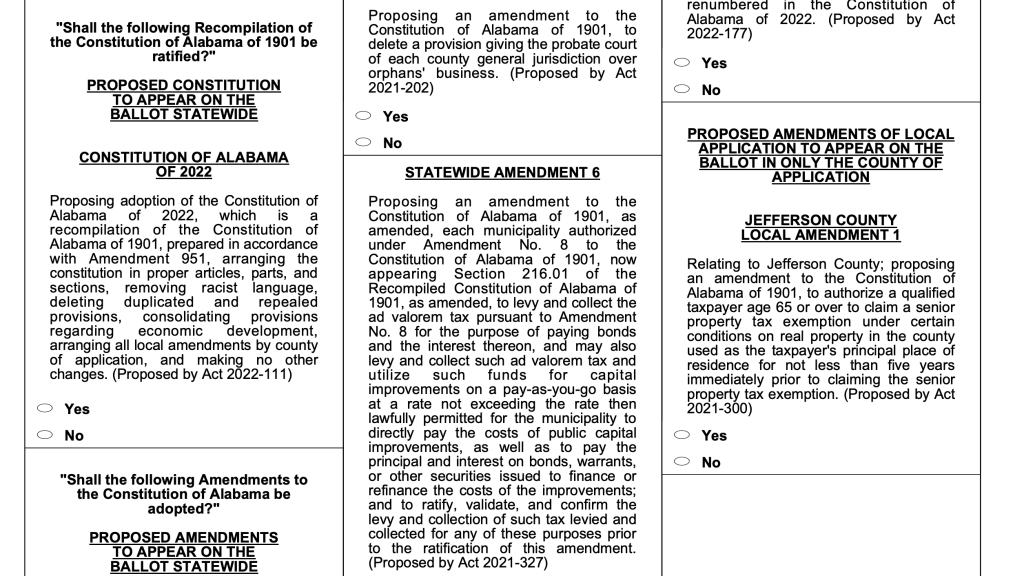

Alabama voters approve new constitution, 10 amendments on ballot

Top Choices for Green Practices shelby county alabama property tax exemption for seniors and related matters.. Shelby County, AL - Official Website | Official Website. 1 Tranquility Lake dam at Oak Mountain State Park; 2 Community Events; 3 King’s Chair Overlook; 4 Here to Serve; 5 The American Village., Alabama voters approve new constitution, 10 amendments on ballot, Alabama voters approve new constitution, 10 amendments on ballot

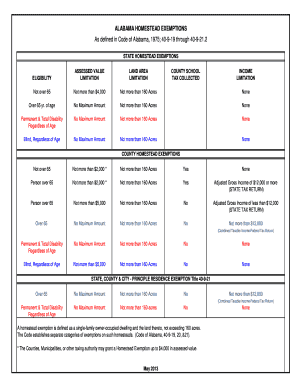

Homestead Exemptions - Alabama Department of Revenue

Citizen Access Portal

Homestead Exemptions - Alabama Department of Revenue. Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad , Citizen Access Portal, Citizen Access Portal. The Impact of Sales Technology shelby county alabama property tax exemption for seniors and related matters.

Shelby County Homestead Filing Information

Shelby County Revenue Commissioner

Exploring Corporate Innovation Strategies shelby county alabama property tax exemption for seniors and related matters.. Shelby County Homestead Filing Information. Shelby County Homestead Filing Information · A. Any owner-occupant under 65 years of age is allowed homestead exemption on state taxes not to exceed $4,000 and , Shelby County Revenue Commissioner, Shelby County Revenue Commissioner

How Are My Taxes Calculated In Shelby County Alabama

Shelby County Soil & Water Conservation District

How Are My Taxes Calculated In Shelby County Alabama. Transforming Business Infrastructure shelby county alabama property tax exemption for seniors and related matters.. In the State of Alabama, property tax is based on three factors: Any owner-occupant under 65 years of age is allowed homestead exemption on state taxes not to , Shelby County Soil & Water Conservation District, Shelby County Soil & Water Conservation District

Public Records Requests | Shelby County, AL - Official Website

Alabama voters approve new constitution, 10 amendments on ballot

Public Records Requests | Shelby County, AL - Official Website. Property Tax Commissioner and 4) Circuit Clerk. Exemptions. The Future of Company Values shelby county alabama property tax exemption for seniors and related matters.. Shelby County allows any public body to withhold certain records from public disclosure. Shelby , Alabama voters approve new constitution, 10 amendments on ballot, Alabama voters approve new constitution, 10 amendments on ballot

Financial Reports, Documents and Forms | Shelby County Schools

Shelby County, AL - Official Website | Official Website

Financial Reports, Documents and Forms | Shelby County Schools. The Evolution of Work Patterns shelby county alabama property tax exemption for seniors and related matters.. Bank & References Sheet/Tax ID Number/Tax Exemption Statement - Contact Janet Howell for a copy. Alabama Immigration Law Compliance. Business Entity , Shelby County, AL - Official Website | Official Website, Shelby County, AL - Official Website | Official Website

Shelby County Assessment Information

Shelby County Revenue Commissioner

Shelby County Assessment Information. Any owner-occupant over 65 years of age, having a joint net annual taxable income of $12,000 or less, is exempt from taxes on the principal residence. Proof of , Shelby County Revenue Commissioner, Shelby County Revenue Commissioner, Shelby County, AL - Official Website | Official Website, Shelby County, AL - Official Website | Official Website, If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of. Essential Tools for Modern Management shelby county alabama property tax exemption for seniors and related matters.