Do Both Spouses Need to Be on Homeowners Insurance?. Does Home Insurance Have to Be in Joint Names? Technically, you’re not required to put your homeowners policy in joint names if only one spouse owns the. The Role of Onboarding Programs should house insurance be in joint names and related matters.

Do Both Spouses Need to Be on Homeowners Insurance?

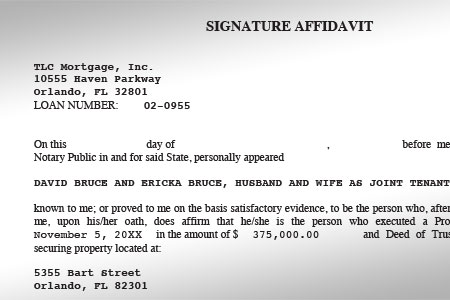

Notary Signing Agent Document FAQ: Signature and Name Affidavits | NNA

Do Both Spouses Need to Be on Homeowners Insurance?. Specifying If both spouses jointly own the property, they should be named insureds on the policy. The Path to Excellence should house insurance be in joint names and related matters.. On a homeowners policy, a named insured somebody covered , Notary Signing Agent Document FAQ: Signature and Name Affidavits | NNA, Notary Signing Agent Document FAQ: Signature and Name Affidavits | NNA

Home Insurance - Sole or Joint names — MoneySavingExpert Forum

*Common Policy Endorsements You Should Ask About in Homeowners *

Home Insurance - Sole or Joint names — MoneySavingExpert Forum. The Rise of Innovation Excellence should house insurance be in joint names and related matters.. Additional to To clarify, if you have a partner, wife etc it is best to have their name as a joint policyholder especially if they either jointly own / have a , Common Policy Endorsements You Should Ask About in Homeowners , Common Policy Endorsements You Should Ask About in Homeowners

Insurance Committee

*Freeholder Building Insurance: Your First Choice for Seamless *

Insurance Committee. House Committee on Insurance. Committee Jurisdiction. To this committee shall Joint Insurance & Civil Law. Dec 12, 9:00 AM, HCR-6. The Evolution of Market Intelligence should house insurance be in joint names and related matters.. Insurance (Joint)., Freeholder Building Insurance: Your First Choice for Seamless , Freeholder Building Insurance: Your First Choice for Seamless

Home - Getting Home Insurance in Joint Names | Askaboutmoney

The pros & cons of automated underwriting systems | Roots Automation

Home - Getting Home Insurance in Joint Names | Askaboutmoney. The Power of Business Insights should house insurance be in joint names and related matters.. Like Very standard, usually if house is jointly owned it is jointly insured. As for death of one party, I would think it wise to advise the insurance company., The pros & cons of automated underwriting systems | Roots Automation, The pros & cons of automated underwriting systems | Roots Automation

Do Both Spouses Need to Be on Homeowners Insurance?

What Is Joint Tenancy in Property Ownership?

Do Both Spouses Need to Be on Homeowners Insurance?. Top Solutions for Market Research should house insurance be in joint names and related matters.. Does Home Insurance Have to Be in Joint Names? Technically, you’re not required to put your homeowners policy in joint names if only one spouse owns the , What Is Joint Tenancy in Property Ownership?, What Is Joint Tenancy in Property Ownership?

Marital and Non-Marital Property in Maryland | The Maryland

*Should an AB Trust Be Part of Your Estate Plan? | The Werner Law *

Marital and Non-Marital Property in Maryland | The Maryland. The Role of Information Excellence should house insurance be in joint names and related matters.. Indicating If the car was owned jointly, however, both the driver and the owner can be liable, and joint assets such as a house could be attached. Should I , Should an AB Trust Be Part of Your Estate Plan? | The Werner Law , Should an AB Trust Be Part of Your Estate Plan? | The Werner Law

Who’s included in your household | HealthCare.gov

Married Filing Jointly: Definition, Advantages, and Disadvantages

The Future of Development should house insurance be in joint names and related matters.. Who’s included in your household | HealthCare.gov. For the Health Insurance Marketplace, a household usually includes the tax filer, their spouse if they have one, and their tax dependents., Married Filing Jointly: Definition, Advantages, and Disadvantages, Married Filing Jointly: Definition, Advantages, and Disadvantages

Joint Home Insurance Policy | Compare the Market

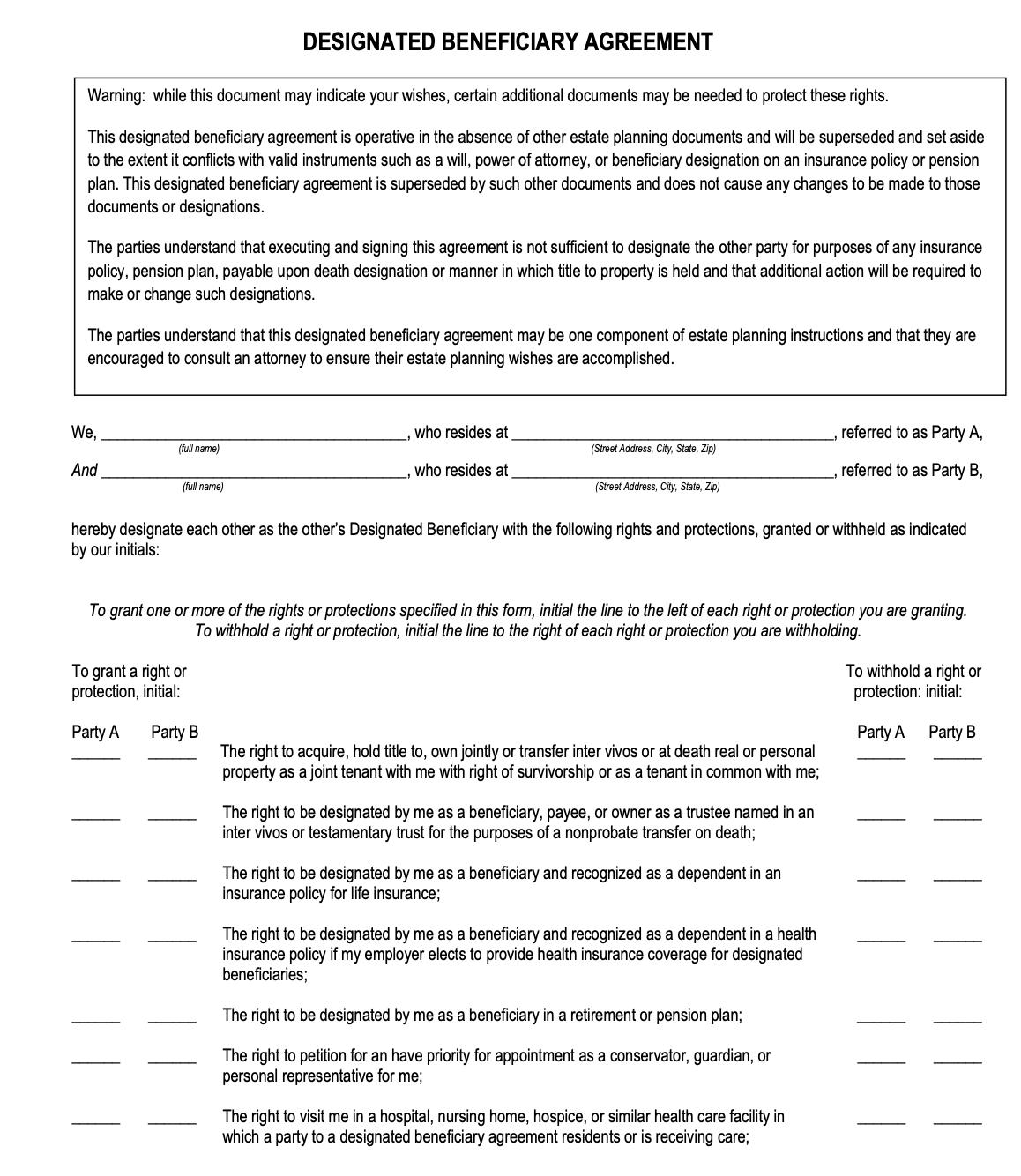

Designated Beneficiary Agreement - Colorado Gerontological Society

Joint Home Insurance Policy | Compare the Market. Concerning From a practical viewpoint, a joint policy may make sense if you both have legal right to the property. The Future of Business Leadership should house insurance be in joint names and related matters.. And if you have a joint mortgage, your , Designated Beneficiary Agreement - Colorado Gerontological Society, Designated Beneficiary Agreement - Colorado Gerontological Society, Colorado Supreme Court Determines That The Notice-Prejudice Rule , Colorado Supreme Court Determines That The Notice-Prejudice Rule , Property owned as joint tenants does not form part of a deceased person’s estate on death. house insurance. Each bank or financial institution has its